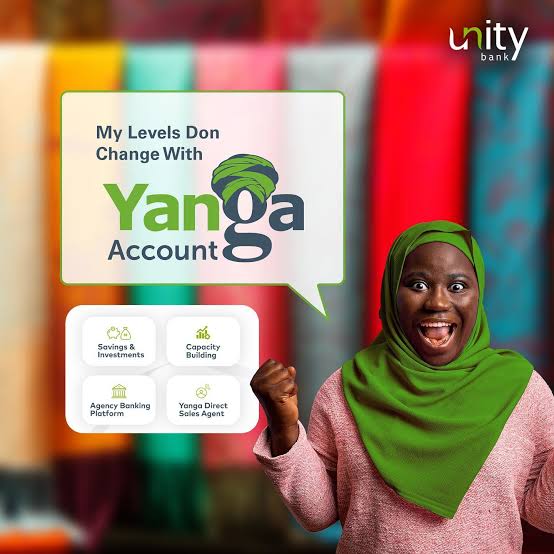

Unity Bank Plc’s Yanga savings account offering has benefitted over 5,000 women entrepreneurs in Nigeria, providing tailored support to female business owners across the country.

The Yanga savings account offering includes capacity building, MSME financing schemes, affordable health insurance, and cash management services. Unity Bank has reached out to beneficiaries through collaboration with about 90 women groups in partnership with the Association of Nigerian Women Business Network (ANWBN).

At a forum in Abuja themed “Building Sustainable Entrepreneurial and Financial Skills for Women in Challenging Times,” Mrs. Adenike Abimbola, the Divisional Head of Retail & SME Banking at Unity Bank Plc, reaffirmed the company’s commitment to supporting women entrepreneurs. She highlighted the successful partnership with ANWBN, which has empowered Nigerian women with skills and credit facilities, expanding the MSME circle in Nigeria.

Ms. Angela Ajala, the National Coordinator of ANWBN, commended Unity Bank for its support and emphasized the importance of equipping women with the tools, resources, and knowledge needed to thrive as entrepreneurs and financial leaders.

The Yanga Savings Account, launched in 2021, aims to boost Nigerian women entrepreneurs, promote their businesses, and enhance their skill sets while providing access to micro-loans and health insurance. Unity Bank’s partnership with SkillPaddy to empower 1,000 female beneficiaries in Software Engineering Training further demonstrates its commitment to women empowerment initiatives, in line with International Women’s Day 2024.