The federal government has outlined new strategies to optimize national assets, improve efficiency, and enhance financial sustainability as part of efforts to reduce reliance on borrowing and boost revenue generation.

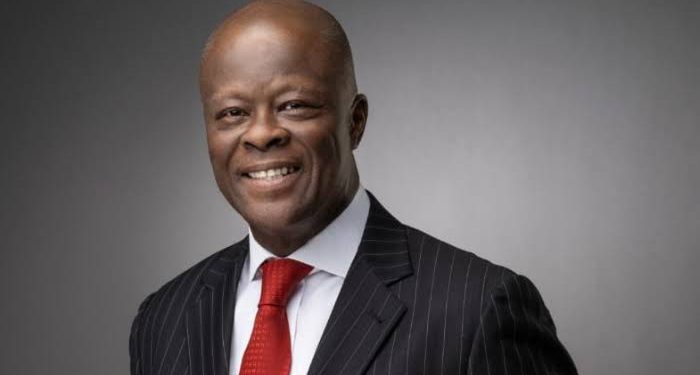

Finance Minister and Coordinating Minister of the Economy, Wale Edun, stated that these initiatives have already contributed to lowering Nigeria’s dependence on high-cost commercial loans. Speaking at a high-level interactive session in Abuja, he emphasized that the government is shifting towards alternative funding sources, including revenue generation, concessional loans, and strategic investments.

The two-day event brought together Senate and House Finance Committee members, heads of government agencies, and ministry officials to strengthen collaboration on sustainable financial management and national development.

Edun highlighted that the administration has reached a stage where optimizing resources takes priority over borrowing from commercial markets. He described this shift as essential for promoting fiscal responsibility and easing the financial strain caused by costly loans.

He reiterated the government’s focus on enhancing transparency, reducing waste, and fostering accountability in public financial management. According to him, the goal is to attract more private sector investments—both domestic and foreign—while maximizing the value of existing public assets.

Edun also expressed confidence in the administration’s economic strategy, stating that macroeconomic tools can significantly reduce poverty and drive sustainable development. He underscored the importance of collaboration between key stakeholders under President Bola Ahmed Tinubu’s leadership to achieve these objectives.

Senator Ita Enang, the lead speaker at the event, addressed the need for seamless coordination between the Executive and the Legislature in advancing economic policies. He stressed that legislative committees must obtain resolutions from their respective chambers before launching investigative hearings involving government officials.

To improve communication between the Executive and the National Assembly, Enang proposed establishing an Economy Coordination Liaison Mission within the Ministry of Finance. This mission would work closely with the Ministry of Budget and Economic Development and the Budget Office of the Federation to ensure smoother legislative interactions.

Enang also highlighted the role of liaison officers from institutions such as the Central Bank of Nigeria (CBN), the Nigerian Deposit Insurance Corporation (NDIC), the Nigerian Maritime Administration and Safety Agency (NIMASA), and the Nigerian Ports Authority (NPA) in advancing relevant bills. He recommended that these personnel operate under a unified directive from the Coordinating Minister of the Economy to maintain coherence in policymaking and prevent conflicting economic measures.

He warned that allowing agencies to work in isolation could strengthen individual institutions at the expense of national economic stability. By fostering better coordination, he argued, Nigeria can ensure that economic policies align with broader development goals.