Nigerian fintech giant PalmPay has launched its first debit card in partnership with Verve, marking a key step in its transformation from a mobile wallet to a full-service digital financial platform. The move aligns with a growing trend among Nigerian fintechs shifting to local card schemes as rising costs and declining international spending make Visa and Mastercard less attractive.

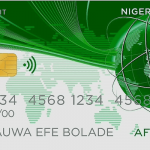

This comes three weeks after PalmPay partnered with the national domestic card scheme, AfriGo, to distribute five million contactless payment cards across Nigeria. Now, the company is integrating Verve-powered debit cards directly into its digital wallet, with distribution planned through its network of over one million agents nationwide. PalmPay expects to onboard millions of cardholders by the end of the year.

The new debit cards come in two tiers: a standard version available to all users and a premium version linked to a new membership program. Premium users must maintain a monthly balance of at least ₦20,000 and transact a minimum of ₦500,000 per month. In return, they will earn up to 36% annual savings interest—compared to 20% for regular users—along with higher cashback rewards and merchant discounts.

PalmPay’s chief marketing officer, Sofia Zab, explained that the company waited until it could fully integrate card services into its wallet before launching. She noted that while other fintechs quickly introduced prepaid cards through third-party APIs, PalmPay opted for a more deliberate approach by forming a direct partnership with Verve to tailor its offering to Nigerian consumers.

The launch reflects a broader shift among Nigerian fintechs embracing local card providers. Opay and Moniepoint have issued around 17 million Verve cards since the pandemic, moving away from international partners. Carbon, a digital bank focused on lending, recently partnered with Verve to resume issuing debit cards after a nine-month pause.

Despite a rising preference for bank transfers in Nigeria’s fintech space, PalmPay sees a continued need for physical and digital cards. According to Zab, not all users are urban, digital-first consumers. Many live in areas with limited phone access or prefer the flexibility of card payments. By offering cards alongside its app, USSD services, and agent network, PalmPay aims to cater to every Nigerian.

Beyond payments, PalmPay is expanding its financial ecosystem with savings, credit (via a licensed partner), and insurance products offered in collaboration with AXA Mansard and Leadway. Over one million users have already adopted its insurance services. The company also plans to open more offices and experience centers nationwide to support its growing customer base.

PalmPay’s investment in debit cards signals that, even as digital banking advances, traditional financial tools remain essential in Nigeria’s evolving financial landscape.