The Federal Inland Revenue Service (FIRS) has unveiled the Merchant Buyer Solution (MBS) e-Invoicing system, an innovative digital platform aimed at modernizing Nigeria’s fiscal infrastructure and enhancing tax compliance across the country.

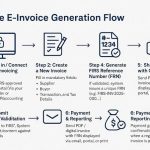

Launched on Wednesday during the inauguration of the National Electronic Invoicing Initiative’s Steering Committee, the new system is designed to standardize invoice creation and exchange across both public and private sectors. It aligns with the Digital Public Infrastructure (DPI) framework, which incorporates identity, data exchange, and payment integration for enhanced accountability and oversight.

Sadiq Arogundade, Technical Lead for the National e-Invoicing project, emphasized the system’s transformative potential. “We are ensuring invoice creation and exchange conform to DPI principles. Identity is central—we know where each invoice originates and where it goes. This fosters integrity and real-time transparency in transactions,” he said.

The pilot phase is currently in progress and involves major institutions such as the Nigeria Inter-Bank Settlement System (NIBSS), Nigeria Customs Service, Office of the Accountant-General of the Federation, and leading private sector players including MTN, CEPLAT, UBA, and Huawei, the latter of which is already fully integrated into the system.

According to Arogundade, the pilot currently focuses on large corporate taxpayers with complex ERP systems, enabling FIRS to manage implementation feedback before expanding to medium and small-scale enterprises.

Speaking earlier, Tayo Koleoso, Chief of Staff to the FIRS Executive Chairman, described the initiative as a landmark in Nigeria’s tax reform efforts, noting that it will enable real-time visibility into commercial activities and improve national revenue mobilization.

“This is more than a tech upgrade, it is a strategic, national initiative championed by FIRS Chairman Dr. Zacch Adedeji to deliver fiscal transparency and cross-agency coordination,” Koleoso said.

The MBS e-Invoicing platform is expected to streamline tax administration, minimize leakages, and foster a more compliant and accountable business environment in Nigeria.