Nigeria is preparing to inject another $100 million into the ECOWAS Bank for Investment and Development (EBID), reinforcing its position as the bank’s largest shareholder and deepening its commitment to regional development across West Africa.

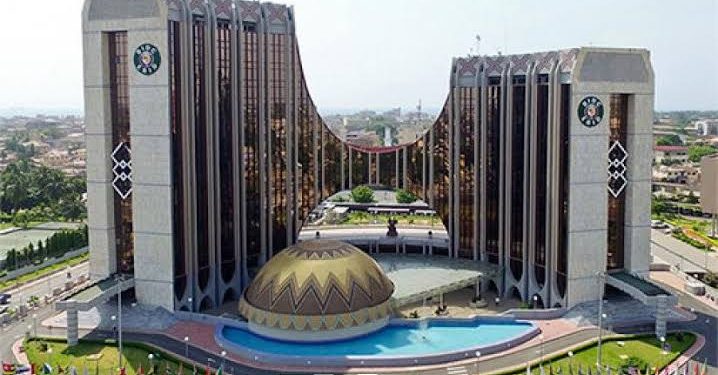

This was revealed during an interactive session at the First Ordinary Session of the ECOWAS Parliament in Abuja. The session, which brought together heads of ECOWAS institutions and specialised agencies, was held to assess EBID’s progress and its strategic role in driving economic transformation, sustainable growth, and regional integration.

The EBID President, represented by Director of Research and Strategic Planning, MacDonald Goanue, stated that Nigeria currently holds approximately 33% of the bank’s total shares, making it the dominant stakeholder ahead of Ghana and Côte d’Ivoire.

“Beyond being the largest contributor, Nigeria is in the process of paying an additional $100 million to the bank,” Goanue confirmed.

Since its inception in 1999, EBID has disbursed over $2.5 billion to support more than 300 development projects across the ECOWAS region. In 2024 alone, it approved 10 new projects valued at $439.74 million and assessed 21 additional ones. These investments span critical sectors including infrastructure, energy, health, agriculture, education, and digital innovation.

Among the bank’s flagship regional initiatives are power grid interconnections between Mali and Côte d’Ivoire, solar electrification of 750 facilities in Benin, and the construction of a strategic bridge connecting AIBD to Blaise Diagne Airport in Senegal.

MSMEs have also received increased support through EBID’s targeted financing programs and public-private partnership initiatives, particularly in agro-processing and manufacturing. The number of projects receiving funding rose from 56 in 2023 to 77 in 2024, although the disbursement rate slightly dipped from 21.58% to 20.54% year-on-year.

In Nigeria, EBID has partnered with institutions like the Bank of Industry and several commercial banks to finance private sector projects, further demonstrating its reach and relevance in the country’s development landscape.

The bank’s president underscored that EBID is not a commercial bank and does not accept deposits, relying instead on member states’ contributions and international funding lines. He noted that India has extended a $1 billion facility to EBID since 2006, enabling expanded investments in infrastructure, energy, and private sector growth across the subregion.

In a related development, EBID recently approved €230 million and $10 million in financing to boost socio-economic development across West Africa. A significant portion of this funding includes a $180 million credit line to Mota-Engil Nigeria for the construction of the Kano–Maradi standard gauge railway. This key infrastructure project will connect Northern Nigeria to Niger Republic, enhancing regional trade and mobility. It is expected to create over 100,000 jobs during construction and 20,000 permanent positions upon completion.

The EBID leadership reaffirmed the bank’s strategic partnership with the ECOWAS Parliament as central to fostering a stable, integrated, and prosperous West Africa.