Nigeria witnessed a sharp rise in foreign exchange inflows via International Money Transfer Operators (IMTOs) in 2024, with a total of $4.76 billion recorded for the year—a significant 44.5 percent increase from the $3.30 billion received in 2023. The data, published in the Central Bank of Nigeria’s (CBN) latest quarterly bulletin, underscores the growing importance of diaspora remittances in sustaining Nigeria’s foreign exchange market amid persistent challenges.

The year began strongly, with January inflows hitting $390.86 million, a 32.5 percent year-on-year rise. February posted a more dramatic increase of 67.3 percent, bringing in $326.91 million. March saw a 30 percent rise with $363.76 million, while April marked the highest year-on-year growth at 83.3 percent, with inflows of $466.11 million.

Momentum continued into May with $404.75 million, up 45.3 percent, and June recorded $389.79 million, a 40.2 percent jump from the same month in 2023. The peak months came in July and August, which posted inflows of $552.94 million and $585.21 million, respectively—together accounting for nearly a quarter of the year’s total remittances. July’s figure was more than double the previous year’s, representing a 130 percent increase, while August followed with a 116 percent rise.

The latter part of the year saw a mixed trend. September brought in $336.61 million, up 40.8 percent; October followed with $378.85 million, marking a 29.1 percent rise. However, November declined by 22.1 percent to $252.28 million. December rebounded with $316.59 million, a modest 9.1 percent increase.

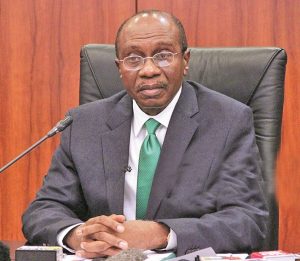

Analysts attribute this remittance boom to wide-ranging reforms implemented by the CBN under the leadership of Governor Olayemi Cardoso, who assumed office in September 2023. A major shift came in January 2024 when the CBN removed the cap on exchange rates quoted by IMTOs, previously restricted to within ±2.5 percent of the market closing rate. This move allowed IMTOs to offer more competitive rates, increasing the attractiveness of official remittance channels.

Further regulatory updates followed, including a new operating framework for IMTOs that raised the application fee for a licence from N500,000 to N10 million and set a $1 million minimum operating capital requirement for both foreign and local entities. Initially barred from purchasing FX from the domestic market, IMTOs were later permitted to participate again in the official market.

The CBN also fostered a more competitive environment by approving 14 new Approvals-in-Principle (AIPs) for IMTOs and establishing a Collaborative Task Force directly overseen by the CBN Governor. The aim of the task force is to double remittance inflows through increased competition, better engagement with the diaspora, and improved transparency in FX transactions.

The CBN’s reforms have not only enhanced regulatory clarity and boosted investor confidence but have also significantly increased Nigeria’s foreign exchange supply, providing much-needed support for the economy, households, and small businesses.

As Nigeria continues to face pressure on its FX reserves, the sustained growth in remittances via IMTOs signals a resilient and increasingly formalized channel for foreign currency inflows