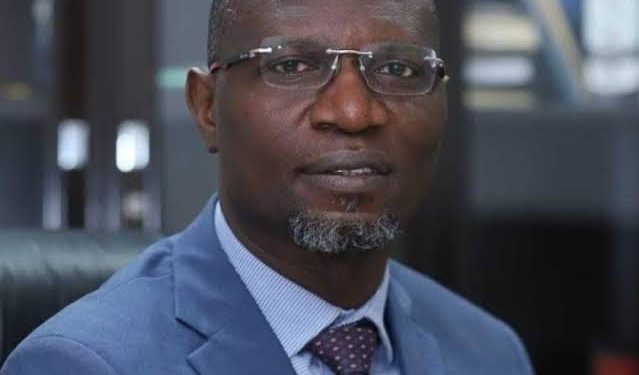

The Director-General of Nigeria’s Securities and Exchange Commission (SEC) has called for urgent mobilisation of capital markets to close Africa’s growing climate adaptation financing gap, which he says could reach \$100 billion annually by 2030.

Speaking at the African Development Bank’s recent annual meeting, the SEC boss stressed the importance of mobilising both public and private investment through capital markets to confront the continent’s worsening climate challenges. Despite contributing less than 4 percent of global greenhouse gas emissions, Africa suffers over 25 percent of climate-related losses, according to Agama.

In his presentation titled “The Role of Capital Markets in Closing Financing Gaps for Climate Adaptation,” he cited the 2022 African Economic Outlook report, which estimated Africa needs around $500 billion by 2030 for climate finance. Implementing Nationally Determined Contributions under the Paris Agreement would require over \$3 trillion in investments across mitigation and adaptation.

Agama noted these figures are not just statistics but indicators of deep vulnerability across the continent, already evident in lost livelihoods in the Sahel, collapsing fish stocks in the Gulf of Guinea, and worsening floods in Lagos and Nairobi. He also referenced the 2023 UN Environment Programme Adaptation Gap Report, which estimated that developing countries will need between $212 billion and $387 billion annually for adaptation by 2030, with Africa’s shortfall up to 50 times greater than current funding levels.

To bridge this gap, Agama urged African project developers and private sector actors to build strong, bankable, and environmentally sound projects ready for financing. He identified the capital market as a vital tool in mobilising resources by promoting regional market integration, standard alignment, and adoption of frameworks such as the International Sustainability Standards Board (ISSB) reporting guidelines.

He noted that Nigeria’s experience with the 2017 sovereign green bond—the first in sub-Saharan Africa—shows the potential of domestic capital. The bond was oversubscribed by 2.5 times, largely by pension funds and diaspora investors, demonstrating that local institutions are willing to support green projects when confidence and appropriate instruments are available.

Agama highlighted Nigeria’s leadership in sustainability reporting, referencing the SEC’s role on the ISSB’s Adoption Readiness Working Group. Nigeria has already developed a phased roadmap to adopt the IFRS S1 and S2 Sustainability Disclosure Standards. Voluntary implementation will run from 2024 to 2026, with full mandatory adoption set for 2027.

Describing these standards as a “game-changer,” he said they would help attract long-term financing for climate adaptation by improving transparency and credibility across African markets. He also called for harmonised ESG standards across the continent and the use of credit enhancements to reduce risks in early-stage climate-related investments.

Agama concluded with a rallying call for collaboration among African regulators, investors, development institutions, and governments. “Let us seize this moment… to deepen African capital markets and finance the resilience of our continent and our people,” he said.

In a separate statement, the SEC chief encouraged businesses and regulators across sectors to adopt strong environmental, social, and governance practices as a means of achieving sustainable development goals.