The National Insurance Commission (NAICOM) has announced plans to introduce new supplementary guidelines aimed at strengthening retiree life annuity (RLA) funds and reinforcing cybersecurity standards across Nigeria’s insurance industry. These new measures are expected to enhance the financial protection of pensioners and ensure insurance firms remain resilient in an increasingly digital environment.

The announcement was made by Moruf Apampa, Vice Chairman of the Publicity Sub-Committee of the Insurers’ Committee, during a media chat in Lagos. Apampa, who is also the Managing Director of NSIA Insurance, revealed that NAICOM is actively developing these regulatory updates as part of its strategic commitment to safeguarding retiree investments and building public confidence in the annuity system.

According to him, the commission is introducing a supplementary guideline specifically targeted at the management of annuity business. This framework will provide additional oversight to ensure that retirees receive their monthly benefits in full and without delay. He noted that with the increasing number of Nigerians relying on life annuities for post-retirement income, it has become critical to enhance operational standards and oversight in the sector.

“NAICOM is taking proactive measures to ensure that no failure occurs,” Apampa said. “The guidelines will soon be released, and they are meant to build further confidence in the market, protect annuitants, and ensure that retirement income is secure and reliable.”

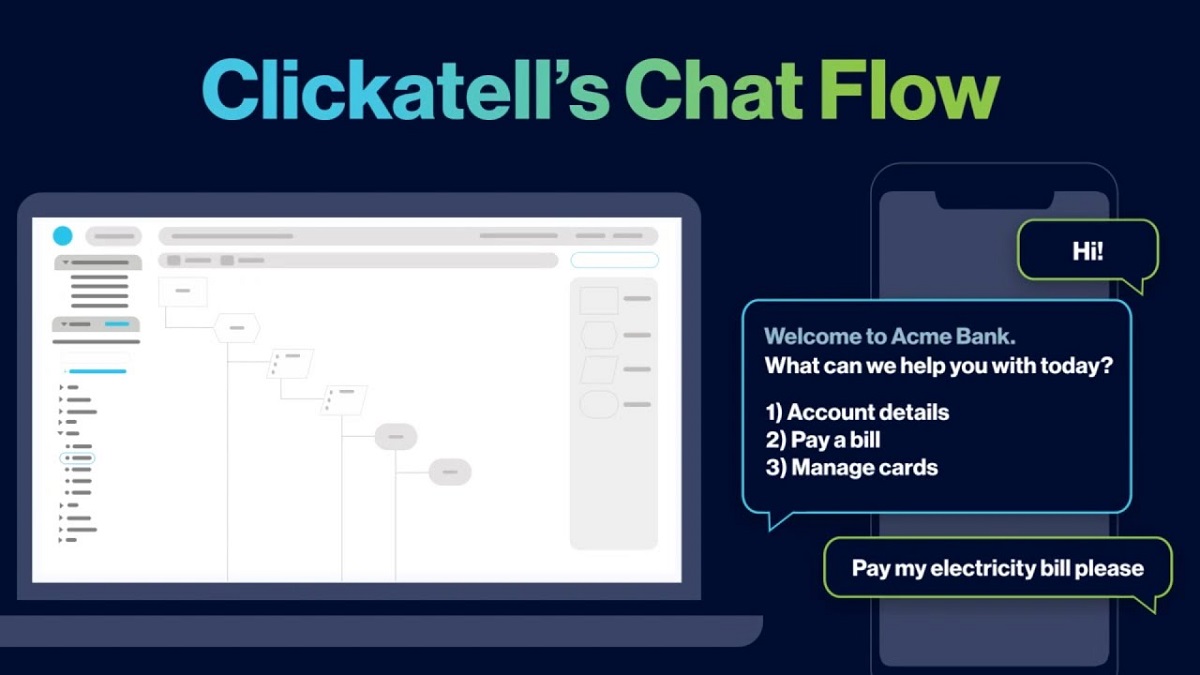

Apampa also highlighted NAICOM’s growing focus on cybersecurity, especially as digital innovation continues to reshape the insurance landscape. He explained that the commission is preparing new policies to help insurance firms manage cyber risks, safeguard customer data, and strengthen digital infrastructure. These guidelines will set clear protocols for risk assessment, incident reporting, data privacy, and resilience planning, ensuring insurers can effectively defend against cyber threats.

“As the industry undergoes rapid digital transformation, the risks evolve too. NAICOM is therefore committed to setting up frameworks that will ensure not just financial protection but digital safety as well,” he added.

Beyond regulatory reform, NAICOM has also been closely monitoring claims settlements and has observed growing compliance from insurance providers. Apampa commended insurers for improving their claims processes and urged them to maintain the momentum while striving for greater transparency and customer satisfaction.

The upcoming guidelines form part of NAICOM’s broader regulatory modernization agenda aimed at improving governance, risk management, and innovation in the insurance sector. With a rising population of retirees and expanding digital exposure, the commission believes that strong and forward-looking regulation is essential to ensure both consumer protection and sectoral growth.

As these reforms take shape, stakeholders are encouraged to prepare for compliance and collaborate with regulators to build a more resilient and trustworthy insurance ecosystem in Nigeria.