The 2025 Nigerian Tax Reform Acts introduce major changes for MSMEs, including tax reliefs, digital filing, and formalization incentives. Learn what your small business must do On June 26, 2025, a bold step toward tax modernization was taken when President Bola Ahmed Tinubu signed into law four key tax reform bills: the Nigeria Tax Act (NTA), Nigeria Tax Administration Act (NTAA), Nigeria Revenue Service Act (NRSA), and the National Fiscal Responsibility and Debt Management Act (NFRDMA). These new laws are designed to simplify the tax system, expand the tax net, and improve revenue generation without stifling business growth, especially among Micro, Small, and Medium Enterprises (MSMEs).

With MSMEs contributing over 48% to Nigeria’s GDP and employing over 80% of the workforce, the impact of these reforms on their operations cannot be overstated.

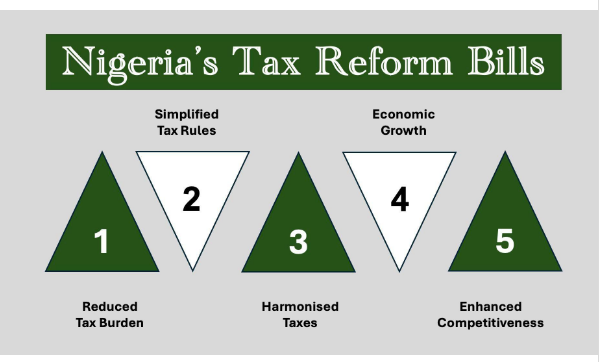

A key highlight of the reform is the simplification of the tax code. The government has introduced a unified tax framework that consolidates federal taxes, removes duplication, and harmonizes processes across states. This is a big win for small business owners who have long battled multiple taxation, confusion over levies, and inconsistent enforcement by different tiers of government.

The reforms also increase the turnover threshold for simplified tax filing from ₦25 million to ₦50 million, exempting more businesses from complex tax obligations and audits. In addition, digital tax platforms now allow MSMEs to file and pay taxes from anywhere, significantly reducing the cost and time burden of tax compliance.

To encourage informal businesses to come under the tax net, the government has introduced a formalization incentive; businesses newly registered with the Corporate Affairs Commission (CAC) are now eligible for a one-year startup tax credit. There is also a two-year tax holiday for MSMEs operating in priority sectors like agriculture, manufacturing, and tech.

The Acts also eliminate some nuisance taxes and arbitrary levies that have burdened micro-enterprises. These include suspending certain local government charges for businesses earning below ₦10 million, providing much-needed relief for very small businesses.

Moreover, MSMEs investing in productive equipment can benefit from enhanced capital allowances that reduce their taxable income, thereby encouraging reinvestment and growth.

The digitization of tax administration is one of the most far-reaching components of the reform. A unified e-tax portal now serves as the single platform for tax registration, filing, payment, and communication. A unique taxpayer ID linked to NIN or BVN is now mandatory, enabling easier tracking and reducing fraud.

With the rise of digital businesses, especially in fintech and e-commerce, the reforms introduce a clear tax framework for online vendors and service providers. These rules clarify the thresholds for compliance and reporting, bringing structure to a previously grey area of taxation.

A dedicated MSME tax support program is part of the reforms, offering educational clinics, simplified audit processes, and fast-track dispute resolution through the Tax Appeal Tribunal. The introduction of a national taxpayer charter also guarantees the rights of small business owners to fair treatment, transparency, and timely resolution of complaints.

Even though the new framework requires MSMEs to improve their record-keeping and digital readiness, it simultaneously protects them from harassment and overreach by tax agents.

What MSMEs Must Do Now

To benefit from the reforms, MSMEs need to:

- Formalize their businesses if they are currently operating informally.

- Register for a Business Taxpayer ID and migrate to the new digital tax portal.

- Review their annual turnover and determine their eligibility for reduced tax rates or exemptions.

- Leverage new incentives such as tax holidays, startup credits, and VAT exemptions on essential inputs.

- Attend tax clinics or partner with business support organizations to stay compliant.

For Nigerian entrepreneurs, these reforms offer a rare opportunity: to align with the law while unlocking new avenues for expansion. They address long-standing pain points around multiple taxation, informality, and limited support for MSMEs. While compliance may demand more digital literacy and formal processes, the long-term benefits, greater clarity, fairness, and access to incentives, can drive MSMEs toward profitability and sustainable growth.