United Bank for Africa Plc has secured a ₦5 billion loan facility from the Bank of Industry (BoI) to boost the growth of micro, small and medium enterprises (MSMEs) in Nigeria, with a primary focus on women-owned businesses.

According to a statement from UBA on Sunday, the facility is being disbursed through the Federal Government’s MSME Fund to stimulate key sectors of the economy while providing affordable financing for businesses in Green Energy, Education, Healthcare, and Women-Owned Enterprises.

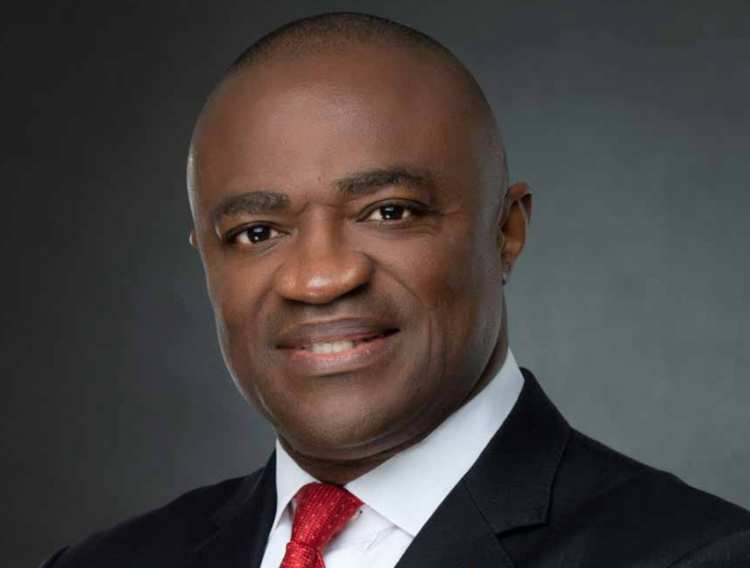

UBA’s Group Managing Director/CEO, Oliver Alawuba, described MSMEs as the “lifewire of any developing economy” and stressed the bank’s commitment to fostering economic growth through empowerment.

“At UBA, we recognise the pivotal role MSMEs play in driving development, and how they account for a sizable portion of economic activity. By offering loans at a competitive 9% interest rate with a three-year tenor, we are removing traditional barriers that hinder SME growth in Nigeria and across Africa,” he said.

Under the arrangement, eligible businesses can access up to ₦5 million per obligor, with a three-month moratorium on principal repayments, allowing time for stabilisation before repayment begins.

UBA’s Group Head of Retail and Digital Banking, Shamsideen Fashola, said the bank is deliberately targeting sectors that are central to national growth and financial inclusion.

“This facility aligns with our broader mission of financial inclusion and economic empowerment. By focusing on Green Energy, Education, Healthcare, and Women-Owned Enterprises, we are supporting Nigeria’s path to sustainable development,” he stated.

Also speaking, UBA’s Group Head, Marketing and Corporate Communications, Alero Ladipo, encouraged MSME operators, especially women, to take advantage of the initiative.

“What sets this programme apart is its accessibility and affordability. We urge business owners to visit any UBA branch or the bank’s website to begin the application process right away.”

The initiative is expected to make a meaningful contribution to Nigeria’s economy by strengthening MSMEs, promoting sustainability, and advancing women’s participation in enterprise.