President Bola Ahmed Tinubu has unveiled a Personal Income Tax (PIT) calculator to help Nigerians estimate their tax obligations under the new tax reform laws, which will take effect from January 1, 2026.

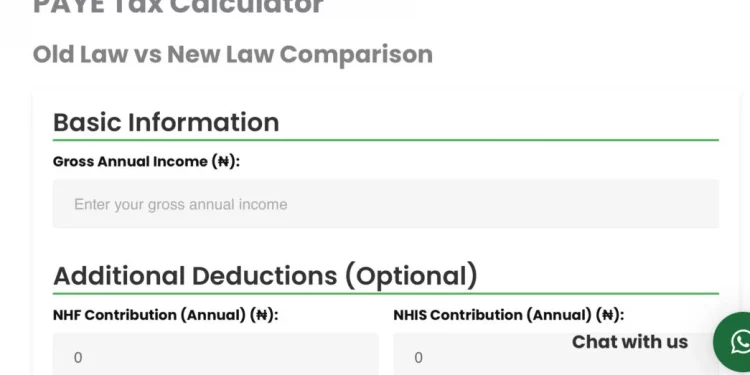

Announcing the tool in a post on his official X account on Friday, the President explained that the calculator enables citizens to compare their current tax payments with what they would owe under the new system, thereby giving individuals clarity on the reforms’ impact on their incomes.

“A fair tax system must never punish poverty or weigh down the most vulnerable. With the new tax laws I recently signed, we have lifted this burden and created a path of equity, fairness, and true redistribution in our economy,” Tinubu said.

The calculator is now accessible at fiscalreforms.ng.

Background to the Tax Reforms

In June 2024, Tinubu assented to four key tax reform bills after months of heated debate and stakeholder consultations. These laws aim to simplify Nigeria’s complex tax system, reduce the multiplicity of taxes, and promote ease of doing business.

The four bills include:

- Nigeria Tax Bill (Ease of Doing Business): Consolidates fragmented tax laws into a single, harmonised statute to reduce compliance burdens and duplication.

- Nigeria Tax Administration Bill: Establishes a uniform framework for tax administration across federal, state, and local governments.

- Nigeria Revenue Service (Establishment) Bill: Repeals the FIRS Act, creating the Nigeria Revenue Service (NRS) as a more autonomous and performance-driven body.

- Joint Revenue Board (Establishment) Bill: Strengthens cooperation among revenue authorities and introduces oversight bodies such as a Tax Appeal Tribunal and a Tax Ombudsman.

What This Means for Nigerians and MSMEs

With implementation set for January 2026, Nigerians—especially low-income earners and small businesses—are expected to benefit from:

- Pro-people tax cuts: Relief measures targeted at low-income earners, families, and MSMEs.

- Transparency & equity: The PIT calculator ensures taxpayers understand their obligations ahead of implementation.

- Ease of compliance: By reducing the number of overlapping taxes, businesses can save time and resources.

- New governance structure: The Nigeria Revenue Service will not only collect taxes on behalf of the federal government but also for states and local governments, ensuring streamlined processes.

According to Tinubu, the reforms represent the first major pro-people tax cuts in a generation, signaling a shift toward fairness, equity, and sustainable growth in Nigeria’s fiscal system.