The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has assured Nigerians that the new tax laws will ease, rather than increase, the financial burden on citizens and businesses.

Speaking on Channels Television on Tuesday, Oyedele said that 97 to 98 percent of Nigerians will either not pay tax at all or pay less than they currently do once the reforms are fully implemented.

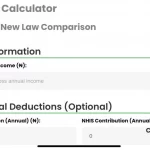

To help Nigerians understand the impact, the committee has launched a digital tax calculator accessible via its website. “With your phone, just put in your income, and it will tell you how much tax you are paying now versus under the new law,” he explained.

How the reforms affect Nigerians

- Low-income earners: Individuals earning ₦100,000 per month or less will be exempted from personal income tax starting January, a threshold higher than the minimum wage.

- Middle-class earners: Those earning around ₦1.8m – ₦1.9m annually will see reductions in their tax obligations.

- High-income earners: High-net-worth individuals will experience marginal increases, a move Oyedele described as global best practice to protect vulnerable groups while ensuring fairness.

Relief for SMEs

Oyedele emphasized that the reforms are designed to support businesses, particularly small and medium-sized enterprises (SMEs).

“Before, the exemption threshold for corporate income tax was ₦25 million. Under this new law, it is now up to ₦100 million. So if your business makes up to ₦100m annually, you don’t pay corporate income tax. It’s zero per cent,” he said.

Tackling multiple taxation

One of the biggest shifts, Oyedele noted, is the committee’s effort to harmonise Nigeria’s over 60 different taxes and levies into fewer than 10.

“We even have bicycle tax, wheelbarrow tax, radio and TV levies in the constitution,” he revealed. “To remove them completely, we need to amend the constitution. But what we are doing now is repealing and harmonizing to achieve a simpler, fairer system.”

Transparency over new taxes

Oyedele stressed that the reform is not about introducing new taxes, contrary to public fears.

“This government has not introduced any new tax. We are repealing, harmonising, and creating transparency so that ordinary Nigerians can understand what they pay, and businesses can thrive without harassment from multiple agencies,” he said.

The reforms are expected to make Nigeria’s tax system simpler, more transparent, and business-friendly, while protecting low-income earners and encouraging SMEs to grow.