Goodwell invests in companies in Africa that aim to make essential goods and services more affordable and accessible. Their focus is not just on financial returns but also on improving lives in low-income communities by strengthening local businesses. For startups who already generate revenue and have demonstrated traction, Goodwell offers more than just cash: they bring mentorship, governance advice, and a network that spans several African countries.

What You’ll Gain (Benefits)

- Capital investment: Funds typically range between USD 250,000 to USD 5 million, depending on size and stage of business.

- Long-term engagement: Goodwell usually partners for 5-7 years with companies, providing support throughout that period.

- Hands-on support: This includes mentorship, strategy refinement, governance, environmental, social, governance (ESG) guidance, and assistance in structuring business operations for scale.

- Network & credibility: Being part of their portfolio connects you to additional investors and gives credibility in markets and supply chains.

Who They Invest In (Eligibility)

To fit Goodwell’s investee criteria, your startup should meet most of the following:

| Criteria | What It Means |

|---|---|

| Location | Based in an African country, or at least substantially serving African markets. |

| Stage | Post-revenue (you already have sales or a customer base); you must show traction. |

| Leadership | Local leadership, with at least one African founder or owner. Diverse leadership is also favoured |

| Impact & Essential Services | Your business should provide essential goods/services (finance, food/agriculture, mobility/logistics, healthcare, etc.) and produce measurable positive environmental or social impact. |

| Growth Potential | Plans to grow significantly over the next 5 years. |

| Commercial Viability | Clear business model, capable management team, and financials demonstrating sustainability or path toward profitability. |

Investment Details & Process

- Ticket size: USD 250,000 – 5,000,000 as typical funding. Smaller investments may happen but rarely.

- Equity / Structure: Goodwell uses equity or mezzanine structures. They tend to take a minority stake and often take board seat

- Exit strategy: While exits are not always frequent, they include trade sales, public offerings, share transfers. The plan depends on the company and the deal.

How Application Works (Timeline & Steps)

| Step | What to Expect |

|---|---|

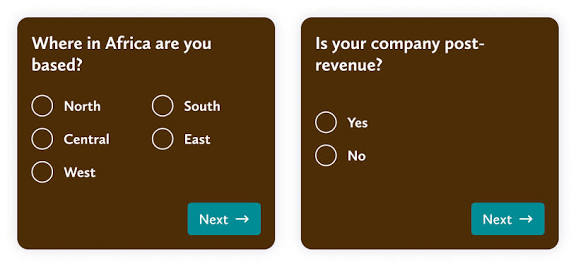

| Step 1 – Questionnaire / Application | Fill out Goodwell’s online form to see if your company is a match. |

| Step 2 – Screening / Intro Call | If preliminary fit is identified, you’ll get a call/meeting to discuss the business, team, ambitions. |

| Step 3 – Due Diligence | As you move forward, Goodwell will request legal, financial, operational documents. There may be iterations. |

| Step 4 – Investment Committee Review | A formal proposal will be built and reviewed by Goodwell’s investment committee for approval. |

| Step 5 – Closing & Long-Term Support | After the deal is closed, Goodwell engages in active, ongoing support. |

Helpful Tips & Common Pitfalls

From observing Goodwell’s past investees and public reports, here are some original tips to improve your chances:

- Show local roots: Demonstrate how local leadership shapes decision-making and your understanding of customer/market context. Generic global branding without local adaptation is less persuasive.

- Be specific with metrics: Use real numbers — revenue, customer growth, margins, unit economics. If your revenue is small, show trend and potential.

- Impact measurement matters: Goodwell values social/environmental metrics. Align your impact reporting to recognized frameworks (e.g., IRIS+, GRI).

- Governance & operations: Have basic legal, financial, and operational systems in place. If you have no board, at least show advisory structure.

- Be ready for long commitment: They expect several years of partnership. Be clear on your plans for scaling and sustainability beyond initial funding.

- Avoid overreaching claims: Be realistic about your capacity, challenges, risks. Investors will look for awareness of potential setbacks.

- Use the questionnaire wisely: The initial quiz/form is a filter. If you clearly match the eligibility, your chances of moving forward are higher.

How to Apply

Go to Goodwell’s “For Investees” page and click Apply for Funding.

- Complete the application/quiz: share your basic details, business model, revenue, impact, team composition.

- If selected, join the deal-screening meeting.

- Move through due diligence if invited.

- Final approval from Investment Committee; then closing of investment and ongoing support.