Accion Microfinance Bank has announced the seventh edition of its Financial Inclusion Seminar, focusing on the impact of digital lending on the informal sector. The virtual event, themed “Digital Lending: A Path to Financial Inclusion or a Barrier for the Informal Sector?”, aims to ignite conversations on the transformative role of digital credit in expanding access to financial services.

Exploring the Promise and Risks of Digital Lending

In a statement released on Wednesday, Accion MfB highlighted the double-edged nature of digital lending:

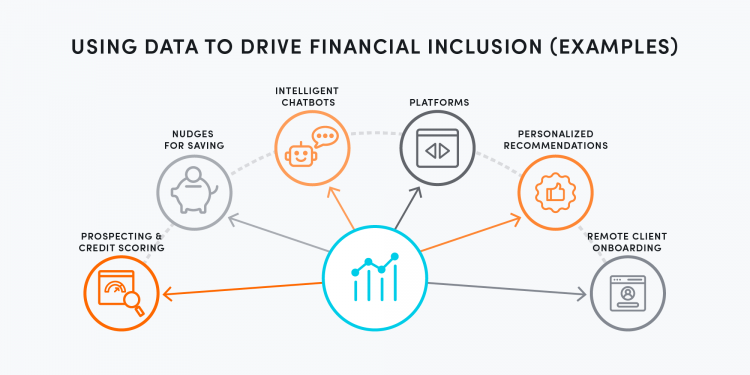

- Opportunities: Digital platforms, such as peer-to-peer lending and online credit services, are often seen as gateways to financial inclusion for underserved communities.

- Challenges: Concerns around digital literacy gaps, accessibility issues, and predatory lending practices may hinder the effectiveness of these platforms in empowering vulnerable populations.

“Are these platforms genuinely enabling financial inclusion, or are they inadvertently creating new barriers?” the statement questioned.

A Legacy of Driving Financial Access

Since 2017, Accion’s Financial Inclusion Seminar series has addressed pressing issues in the financial sector, including digital literacy, innovative financial products, and services tailored for excluded communities. The seminars have become a vital platform for stakeholders to share insights and drive impactful change.

Event Highlights and Participants

The seminar will feature key players across the financial ecosystem, including:

- Policymakers and regulators.

- Microfinance institutions and fintech innovators.

- Development organisations, civil society groups, and impact investors.

- Representatives from financially excluded communities.

By bringing together these diverse voices, the seminar aims to explore actionable solutions to bridge financial disparities while leveraging digital innovations responsibly.

As digital lending continues to rise globally, understanding its implications is critical for advancing financial inclusion in Nigeria’s informal sector, which often lacks access to traditional banking services. Accion MfB’s seminar seeks to provide a balanced perspective, weighing its potential benefits against emerging risks.