Africa-Re’s partnership with IFC (A member of the world bank group) in March 2019 is strategic and symbolic. The Partnership aims at providing technical support to insurance companies for their agricultural line by using index-based agricultural insurance.

This no doubt will trigger innovative and more efficient solutions for small farmers, help them mitigate effects of climate change-related shocks, protect them against catastrophic losses and access to finance.

The African agriculture insurance market has encountered several challenges that have resulted in the very low penetration levels of this class over the years. Initially, indemnity based products were a common feature. However, these products became riddled with high costs of administration and the inherent fraud risks made it difficult for underwriters to implement. Thus a parametric solution was sought, specifically to encourage the smallholder farmers access to insurance at affordable terms. This solution is currently being adopted in many African markets.

Unfortunately, the parametric solution is also encountering many challenges in its implementation. These include high premium rates, high volatility of net account results for risk carriers, low institutional capacity and limited reinsurance capacity.

In order to address these challenges that have impacted the expansion of agriculture insurance solutions in Africa, the IFC’s Global Index Insurance Facility (GIIF) set up an experience account whereby the loss ratios of the net account for local risk carriers would be capped at 75% and the excess loss amounts transferred to the Global Index Insurance experience account. African Reinsurance Corporation acts as the fund administrator. The Global Index Insurance Facility (GIIF) is a multi-donor program managed by the World Bank Group created to address the scarcity of affordable insurance protection against weather and catastrophic risks in emerging countries. GIIF is supported by the European Commission, the African, Caribbean and Pacific (ACP) Group of States, the Netherlands Ministry of Foreign Affairs, the German Federal Ministry of Economic Cooperation and Development (BMZ), and the Japan Ministry of Finance

The pilot phase of the experience account was set up in 2017 for a 3-year period to end in December 2020. The USD$900,000 fund covered Nigeria and Zambia and was intended to support the development of weather and area yield index insurance programs in these countries.

The benefits of the experience account to the index insurance portfolios cannot be overemphasized and include;

- Protection of risk carriers net accounts from adverse loss scenarios whereby they can recover monetary amounts from the fund facility in the event their loss ratios exceed 75%, however capped at some monetary limit.

- Motivation for risk carriers to continue writing agriculture businesses as they know they have some cushion in the event of a bad year. This has resulted in an increased number of licensed agriculture underwriters since 2017. (For example, in Nigeria, the number of licensed underwriters has grown from 4 in 2017 to 15 in 2021).

- Motivation for risk carriers to provide fairly affordable prices to smallholder farmers as well as tailor-made products that are attractive. Smallholder farmers can therefore easily access insurance. The number of insured farmers as well as premiums written for the last 3 years have therefore grown considerably.

“This initiative would certainly go a long way in moving Nigeria towards its goal of food security in line with Africa-Re’s mission to support African economic development“ — Ken Aghoghovbia (DMD/COO-Africa Reinsurance Corporation).

During the last 3 years, the experience account fund has been triggered twice – in 2019 and 2020.In 2019, two risk carriers, Mayfair Insurance Company (Zambia) and AXA Mansard Plc(Nigeria) benefitted from the fund following various flood losses that impacted their net account portfolios.

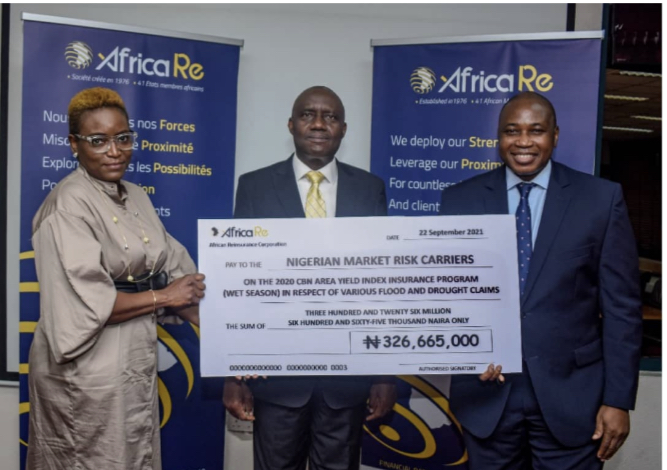

In 2020, the Nigeria market was again hit by flood losses that affected 8 local risk carriers on the CBN Area Yield Index Anchor Borrowers Program (Wet Season) for rice, maize and cotton crops. The total market gross claim was NGN1,995,487,009(Approximately USD$5M) and the local insurers that covered the risk include Veritas Capital, Leadway Assurance, AIICO Insurance, AXA Mansard Insurance Plc and Royal Exchange Insurance Plc. Africa Re paid about US$1.5M to the lead insurer as their reinsurance share of the claim and has handed out a total of US$827,000 to the local risk carriers from the IFC’S GIIF experience account fund.

With the increasing number of agriculture risk carriers as well as smallholder farmers in need of insurance, coupled with the climate change impacts stemming from erratic climatic conditions worldwide, the future of agriculture and hence food security in Africa is uncertain. It is obvious that the need for wider incentive programs such as the GIIF experience account will be key parameters in mitigating challenges associated with these anticipated scenarios in the future.

The IFC/GIIF fund which Africa Re manages on behalf of the agriculture industry stakeholders aligns well with its mission statement of fostering the development of insurance and reinsurance industry in Africa.

Special thanks to GIIF/IFC team as well as the Donors for supporting this initiative in our various markets.