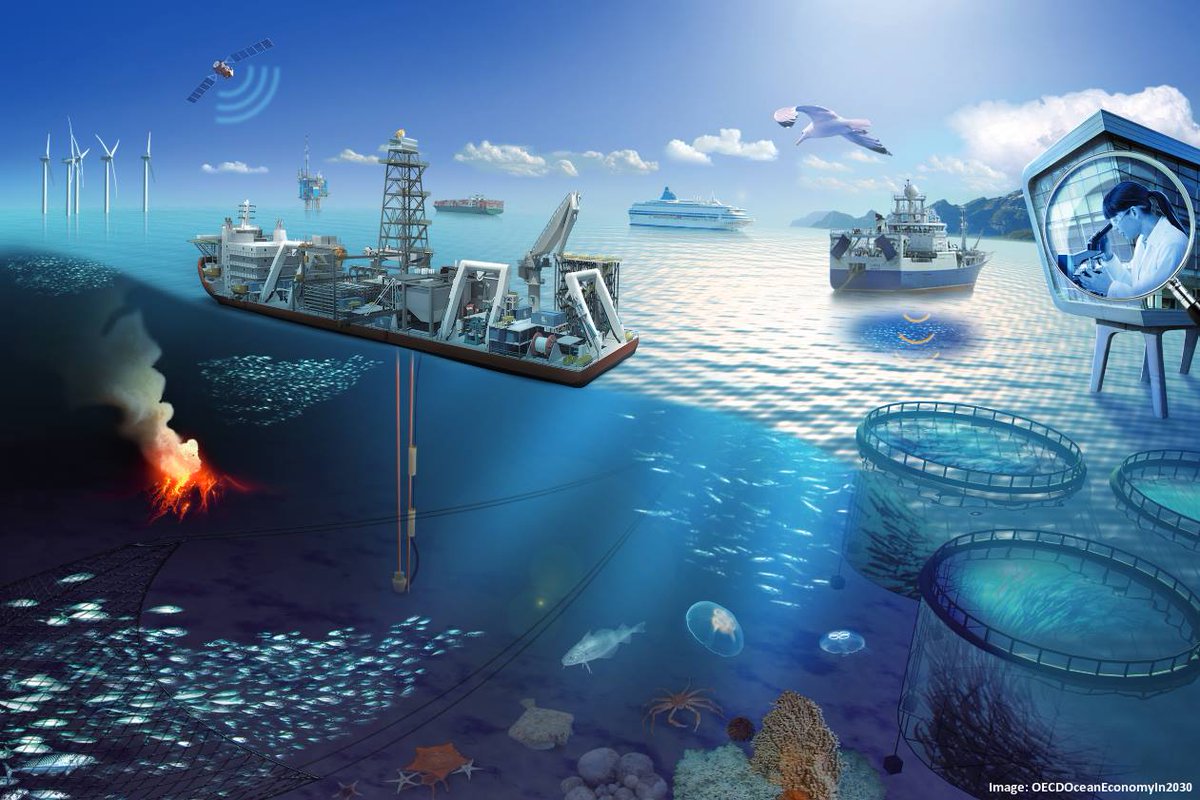

According to Nautic Expo, Global maritime freight transportation revenue is “estimated to reach US $205 billion by 2023, up from US $166 billion in 2017. To do this, the industry—logistics, ports, shipping, etc.—will need to add AI to its armory of digital technologies.”

Data is the new black gold. Data recently exceeded oil as the world’s most valuable resource. Tech giants and digital platforms are leading the charge in the mining of data but new maritime startups are showing up on the digital maritime space. With data seating on the centralized servers of these firms, all the value and economic potential goes to these firms without any restrain. Understanding data as an asset class like oil can open up our minds into the emerging digital shipping decade.

It means for the shipping industry to make significant progress it should classify data as an asset class, enabling us to edge towards better regulations, a pace closer to an equitable and empowering relationships with these emerging digital shipping platforms and the tech giants.

With more than 80% of goods conveyed by sea, African firms have to take a cue from the efficiencies AI is bringing into other industries. They should know that intelligent automation of data processing and management, information extraction and processing, semantic search, and virtual assistants will alter the way they do business. Although for shipping, the potential impact of AI is just unfolding, it leaves maritime regulators like NIMASA to lead digitalization-a truly defining opportunity for the leading West African regulator to shape the evolution of the regional digital maritime space.

Also, the paybacks of leveraging technology in shipping holds the power to impact African businesses and its regulators’ predictive capabilities and making their operations more efficient. Potential applications include real-time analytics, improved scheduling, automated processes, etc. A cross-industry earlier study on AI adoption by McKinsey found that early adopters with a proactive AI strategy in the transportation and logistics sector enjoyed profit margins higher than 5%.

Tarry Singh, a top artificial intelligent (AI) expert said, “It may be an opportunity that shippers should be looking at very seriously. Maritime operations have been extremely optimized, but there is definitely that “last nautical mile” efficiencies such as vessel precision operations using various geographical data to exactly make ETAs/ETDs, fine-tuning container routing, and re-routing, fuel-consumption models that offer “Fuel Savings Guarantees.”

For leading West African regulator like NIMASA and NPA, initiating the digitalization roadmap would serve as an industry pathway to helping maritime industry players identify patterns through Machine Learning, use cases and also becoming aware of and access “big data, IIoT, leveraging up-skilling opportunities for understanding Machine Learning and the import of digitalization and the emerging innovations on workforce and corporate bottom-line.

Notably, digitalization transformation is a process. There will be time constraints, limitations, and development costs but it offers our industry enhanced ways of working smarter, simpler, and more efficiently. We can do a lot with improved analytics for decision-making, automation, safety, route optimization, and increased efficiencies. The transformative impact we see in the African market is that we can ensure our decisions are based on data-proven methods.

As a matter of fact, African maritime regulators will be severely challenged by the digital maritime ecosystem; where smart technologies for the marine and energy markets is disrupting the industry by establishing an ecosystem that is digitally connected across the entire supply chain through applications that are secure, smart, and cloud-based coupled with globally evolving regulations targeting data and digital maritime sovereignty.

What is changing?

The lack of a system to track and tag real-time and past information has made the retrieval of historical data difficult and time-consuming. This is giving way to an AI-driven semantic search engine for information identification with a virtual assistant interface that help controllers make sense and extract information from past operations experiences.

When paper documents like a bill of lading (BL) or a commercial invoice are handled manually, slowing down financing processes and payments between parties — crucial to shipping and logistics. This is giving way to AI solutions that accurately read and extract terms from a bill of lading, removing the need for humans to understand and extract information manually.

Ships spend 40 percent of their time in port, due to a “first come –first served” slot allocation system. Also, ships sail 40 percent of their time at sea in ballast because of a lack of suitable cargo, resulting in ships using only 36 percent of their time creating value for their owners. Therefore represents an incredible inefficiency. This is being resolved by a Singapore-based start-up; it is predicting profitable shipping routes, effectively identifying demand before it emerges using artificial intelligence and machine learning.

Navigating the future

The disruptive and evolving nature of digitalization makes it difficult to respond swiftly with the right regulation. Industry guide may offer us a starting point to handling the outcomes from these digital platforms before we can move to a solid legal framework for innovations like autonomous shipping and the risks outlay.

Another issue is the inescapable downside of deepening technological integration which exposes us to cyber risks. Industry capacity building can help us with constant vigilance and defensive postures which are crucial to the successful implementation of new technology both for regulators and ships owners. There should be a focus on crew and shore based personnel to have the necessary competencies to safely use and maintain innovative applications and equipment.

How do we bake competitiveness into our maritime industry?

There is no other industry where so many industry experts attribute a high importance to data and analytics in the next five years than in the maritime sector. This sector has to start mining its data, enabling its ascendance into the world’s digitally integrated value chain with potential benefit to significantly improve forecasting to scale capacity up or down and plan routes.

As the race is on to define the industry’s future with an estimated US$4.6 trillion of revenues at stake, African companies and regulators should begin to adapt to changing markets proactively. Leveraging new technologies can enable greater efficiency and more collaborative operating models within Africa and the larger world.

To baked competitiveness into our maritime industry, Nigeria, South Africa among other leading maritime hubs, have to provide digital maritime leadership. We need to build digital infrastructure as well as an environment that supports disruptive innovation simulations to our maritime industry. It goes without saying that any of the maritime hubs that offer such an environment conducive for innovation in the maritime industry will generally have a strong competitive edge.

In all, we have to be particularly hands-on in promoting digital innovation and entrepreneurship in Africa’s maritime eco-system. We have to launch maritime-tech contests and collaborative platforms. To build and accelerate these maritime start-ups, we need collaborative platform for technology companies, startups and other maritime stakeholders to co-develop innovative data-driven maritime solutions. This will help prepare us to ride the digital transformation wave of this new decade.

Caesar Keluro works for Nanocentric Technologies. He is also the Founder of ‘Make In West Africa’, a Thinktank.