According to the Nigerian Bureau of Statistics (NBS), Nigeria’s total capital importation in the first quarter (Q1) of 2023 decreased by 28 percent, amounting to $1.13 billion compared to $1.57 billion reported in the corresponding quarter of 2022.

However, the NBS report showed a 6.78 percent increase in capital importation on a quarter-on-quarter basis when compared to the $1.06 billion reported in the fourth quarter of 2022.

During the first three months of 2023, portfolio investments accounted for the largest share of capital inflow, totaling $649.28 million, which represented 57.32 percent of the total capital inflow in the reviewed period. Within the portfolio investments category, Nigeria received $301 million from bonds, $222 million from equities, and $125 million from money markets.

The report further revealed that “Other Investments” accounted for 38.31 percent of the total inflow, amounting to $435.76 million, while Foreign Direct Investment (FDI) stood at $47.60 million, representing 4.20 percent of the capital import.

Disaggregating the data by sectors, the banking sector recorded the highest inflow of capital, amounting to $304.56 million, which represented 26.89 percent of the total capital imported in Q1 2023. This was followed by the production sector, which received capital worth $256.12 million, accounting for 22.61 percent of the total capital, and the IT services sector, which attracted $216.06 million, representing 19.08 percent of the total capital inflow.

The United Kingdom, United Arab Emirates, United States, South Africa, and Singapore emerged as the leading countries in terms of investments into Nigeria. The United Kingdom contributed the highest capital inflow in Q1 2023, amounting to $673.64 million, accounting for 59.47 percent of the total capital inflow. It was followed by the United Arab Emirates with a contribution of $108.28 million (9.56 percent) and the United States with $95.36 million (8.42 percent). South Africa and Singapore also made significant contributions of $91 million and $69 million, respectively.

In terms of foreign capital inflow by sector, the banking sector attracted the largest share, receiving 26 percent of the total foreign capital, valued at $304 million. The production sector followed with 22.61 percent, amounting to $256 million, while IT services accounted for 19 percent, with a value of $216 million.

Other notable sectors included finance with a capital inflow of $118 million, trading with $91 million, telecoms with $22.5 million, and transport with $12.94 million. Agriculture received $4.84 million, while shares rose to $88 million. On the other hand, the oil and gas sectors, brewery, and electricals represented 0.07 percent, 0.06 percent, and 0.65 percent of the total capital inflow, respectively.

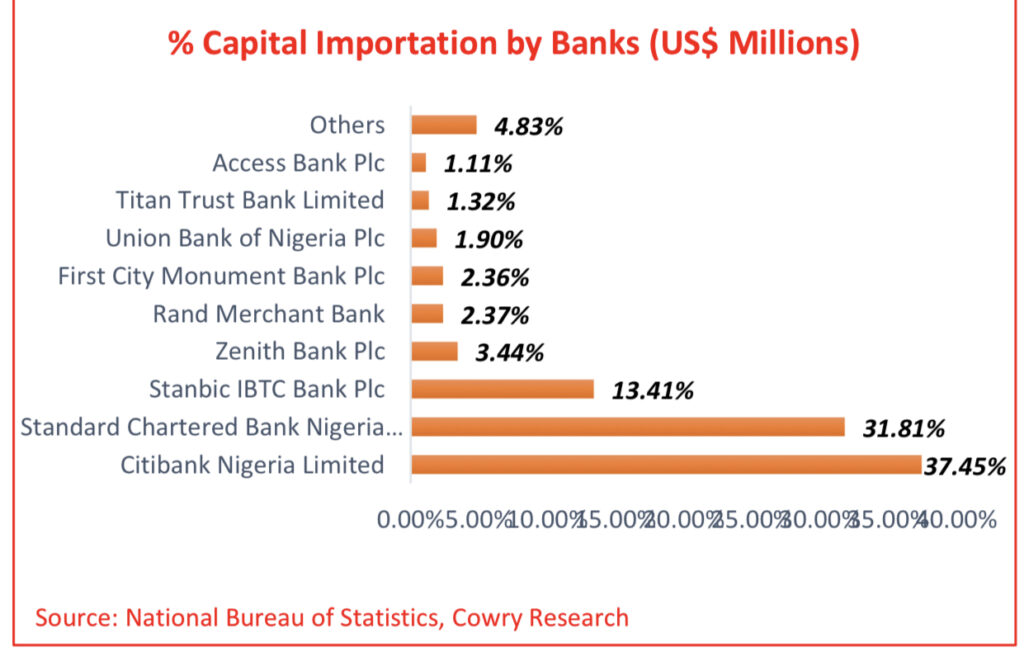

Citibank Nigeria Limited ranked as the top bank in Q1 2023 with a capital importation of $424.13 million, accounting for 37.45 percent of the total inflow. Standard Chartered Bank Nigeria Limited followed with $360.33 million (31.81 percent), and Stanbic IBTC Bank recorded $151.85 million (13.41 percent).