The Central Bank of Nigeria (CBN) has officially approved the implementation of open banking in the country, making Nigeria the first African nation to operationalize the initiative. Beginning in August 2025, banks will be required to share customer data with other regulated financial institutions, marking a significant milestone in the country’s financial innovation journey.

This move comes four years after the apex bank first introduced the regulatory framework for open banking. With this approval, Nigerian bank customers can now consent to allow regulated institutions access to their data, including account balances, transaction histories, and spending patterns, and, in some cases, even authorize transactions on their behalf.

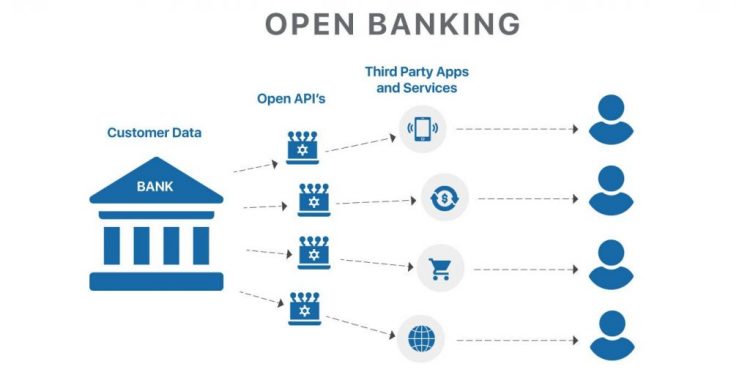

Data exchange will occur via a standardized application programming interface (API) that ensures secure and consistent access across all participants. A central registry will be used to identify and authenticate all licensed parties, while a robust consent management framework linked to customers’ Bank Verification Numbers (BVNs) will ensure that users maintain full control over who accesses their data and how it is used.

In response to industry concerns, the CBN has also adjusted its original plan to centralize the system under the Nigerian Interbank Settlement System (NIBSS). Instead, it has formed independent committees composed of professionals from financial institutions, with no direct control from the CBN, to oversee the implementation and governance of open banking.

Industry analysts highlight the transformative potential of open banking in Nigeria’s financial services landscape. With access to years of transaction data from over 120 million bank customers, financial institutions are expected to develop more inclusive and innovative services.

One of the most anticipated benefits is the transformation of the credit ecosystem. Currently, only about 30% of Nigeria’s bank account holders have access to formal credit. Existing fintech lenders, operating with limited data, have offered credit with mixed results, ranging from subprime loans to aggressive collection practices.

Open banking could change this by giving lending fintechs access to detailed transaction histories and consumer behavior, enabling them to better assess creditworthiness and develop reliable credit scoring systems. This would also open the door for personalized financial products tailored to individual needs, backed by real-time data.

The CBN’s move positions Nigeria as a fintech leader on the continent and signals a shift toward data-driven, customer-centric financial services.

This is a developing story.