As the Central Bank of Nigeria (CBN) prepares for its upcoming Monetary Policy Committee (MPC) meeting, a detailed breakdown of current savings and lending rates across Nigerian banks has been published, offering a window into the cost of credit and return on savings in Nigeria’s tightening monetary landscape.

The data, released by the apex bank, provides transparency into the financial terms offered by Deposit Money Banks (DMBs) and is crucial for small businesses, individuals, and investors seeking to make informed financial decisions.

Latest Savings Deposit Rates: What Banks Are Offering

A savings rate represents the interest banks pay customers to keep their money with them. With monetary policy tightening and rising inflation, many banks have adjusted their rates upward:

Top Saving Rates (%):

- SunTrust Bank – 8.30%

- Access Bank, Fidelity, First Bank, Zenith Bank, UBA, Sterling Bank, Unity Bank – 8.25%

- GTBank, NOVA Bank – 8.00%

- Ecobank – 5.90%

- Stanbic IBTC – 2.75%

- FCMB – 1.15%

Lending Rates: A Mixed Bag for Borrowers

Lending rates are split into two:

- Prime Lending Rate: For borrowers with high creditworthiness.

- Maximum Lending Rate: The highest interest a bank may charge.

Notable Lending Rates (%):

- Highest Maximum Lending Rate: Ecobank – 48.00%, FCMB – 46.00%, Parallax Bank – 42.00%

- Lowest Prime Rate: Titan Trust Bank – 10.00%

- UBA: Prime – 32.00%, Max – 40.00%

- GTBank: Prime – 28.50%, Max – 35.00%

- Zenith Bank: Prime – 25.40%, Max – 35.00%

These rates show the growing cost of accessing credit, especially for MSMEs without top-tier credit profiles.

Banks Earn N14 Trillion from Lending in 2024

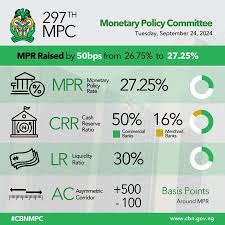

According to data compiled earlier this year, nine major Nigerian banks earned N14.26 trillion in interest income in 2024, nearly double their 2023 earnings. This massive growth was fueled by the CBN’s aggressive monetary tightening, which raised the Monetary Policy Rate (MPR) as high as 35%.

While this has boosted bank profitability, it’s come at a cost:

Rising borrowing costs are choking small businesses, manufacturers, and informal traders, making access to credit more difficult and expensive.

What This Means for MSMEs

For Nigeria’s micro, small, and medium-sized enterprises (MSMEs), these figures paint a dual picture:

- ✅ Savings: Businesses can now earn better interest on deposits (up to 8.25% in many banks), offering some relief from inflation.

- ❌ Loans: Access to capital remains a major hurdle, with lending rates exceeding 30% in most banks. This can stifle growth, delay expansion, and affect job creation.

As the MPC gears up to decide Nigeria’s next interest rate direction, MSMEs must carefully assess their borrowing strategies, savings goals, and credit profiles. Staying informed can be the difference between scaling and stagnation in a high-interest-rate economy.