Six FinTech Companies from Africa have qualified for the final stage of the Ecobank FinTech Challenge 2022.

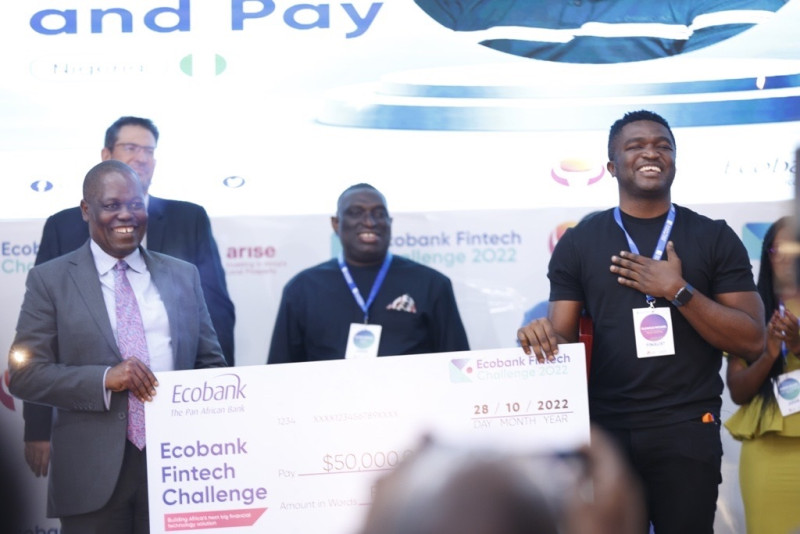

The six finalists were chosen following extremely strong competition from over 700 fintechs from 59 countries; Grand Finale to be held on 28 October at the Ecobank Group Pan African Centre in Lomé, Togo; Finalists will compete for the top price of $50,000 and admission to the ‘Ecobank Fintech Challenge Fellowship’ program.

Ecobank Group, the leading private pan-African banking group, has announced the six finalists for the fifth edition of the Ecobank Fintech Challenge. The finalists come from the Democratic Republic of Congo, Nigeria, Senegal, South Africa and Togo.

The six fintechs stood out from a highly competitive pool of over 700 applicants from 59 countries in and outside Africa. The six finalists will compete for the top price of $50,000 at the Grand Finale, which is being held at the Ecobank Pan African Centre in Lomé, Togo, on Friday 28 October 2022.

The finalists for the 2022 edition, in alphabetical order, are:

Cauri Money, Senegal

DizzitUp, Togo

MaishaPay, Democratic Republic of Congo

Moni Africa, Nigeria

Paycode, South Africa

Touchand Pay, Nigeria

This 5th edition of the Ecobank Fintech Challenge, which is sponsored by Arise, will allow all finalists to benefit from Ecobank’s Fintech Mentoring Programme. During this programme, Ecobank will help them to explore opportunities including:

- Rolling out their products on a pan-African scale: an opportunity to further integrate with Ecobank and potentially launch their products or services in all or part of Ecobank’s 33-country pan-African ecosystem.

- Access to the Group’s pan-African Banking Sandbox to test and develop their products in the pan-African market.

- Priority access to Ecobank’s venture capital partners to explore funding opportunities.

Tomisin Fashina, Ecobank Group Executive, Operations and Technology, said: “I am impressed by the growing number of applications for the Ecobank Fintech Challenge. Applications have grown from about 412 applications in 2018 to over 700 in 2022. This demonstrates a definite paradigm shift within the African continent, with Africans’ desire to transform technological innovation into a real lever for socio-economic development. We thank all applicants for their participation and applaud the highly impressive quality of their entries. We look forward to partnering with them for their groundbreaking digital financial solutions to our continent’s unique challenges and to help promoting financial inclusion on the continent.”

Gavin Tipper, CEO of Arise, partner and co-sponsor of the Ecobank Fintech Challenge 2022 competition, said: “Fintechs play a central role in creating innovative digital solutions that improve customer experience, deliver value propositions and reduce costs. Our investments in fintechs are based on collaborative partnerships that advance financial inclusion on the continent and offer opportunities for mutual synergies with our balanced investment portfolio.”

The Ecobank Fintech Challenge is designed to identify innovative fintechs that are ready to grow, that we can partner with, mentor and give access to Ecobank’s 33 African markets, so that they can realise their potential and become pan-African success stories. This competition is in line with Ecobank’s Fintech strategy of building partnerships with African fintechs to help transform digital finance and banking.

The Ecobank Fintech Challenge is organised in collaboration with partners across Africa and the world, including Arise, gold sponsor of the 2022 edition, Global Finder, TechCabal, Africa Fintech Network and Konfidants.

For more information on the competition, visit www.EcobankFintechChallenge.com