Ecobank Transnational Incorporated (ETI) said it has successfully tapped its $400 million 10.125 percent Notes due October 15, 2029, for an additional $125 million.

The Notes will be consolidated and will form a single series with the $400 million 10.125 percent Notes issued on October 15, 2024.

The offering was issued at a premium with a new issue price of 102.634, or an effective yield of 9.375 percent, representing a 100-basis-point tightening in yield compared to the original issue.

The improved yield demonstrates investor confidence in Ecobank’s strategy execution and growth prospects.

Investor demand was also robust, achieving a final orderbook oversubscription rate of more than 2x, with strong participation from asset managers, banks, and development finance institutions across Africa, the United Kingdom, Europe, the United States, Asia, and the Middle East.

The net proceeds from the issuance of the Notes will be used for general corporate purposes, primarily to refinance upcoming debt maturities.

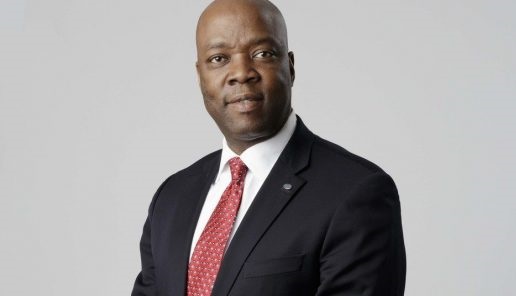

Jeremy Awori, Group CEO, ETI, said: “We are encouraged by the strong support received from international investors, which underscores their continued belief in Ecobank’s resilience and progress in executing our Growth, Transformation and Returns (GTR) strategy. This tap enhances our financial flexibility and further reinforces our presence in the global capital markets.”

Ayo Adepoju, Group Chief Financial Officer of ETI, added: “This successful tap further strengthens ETI’s financial position in line with its strategic objectives and reflects the institution’s commitment to proactively manage its balance sheet by diversifying funding sources and extending the average debt maturity profile of the Group. We remain grateful for the support and partnership from Absa, Africa Finance Corporation, African Export-Import Bank, Mashreq, and Standard Chartered Bank, who acted as Joint Lead Managers and Joint Bookrunners, Ecobank Development Corporation, which acted as Co-manager, and Renaissance Capital Africa, which served as the Financial Adviser for the transaction”.