The Federal Airports Authority of Nigeria (FAAN) has officially begun using a cashless payment system at the Nnamdi Azikiwe International Airport (NAIA) in Abuja, introducing a unified digital wallet for all transactions as part of efforts to modernise airport operations and curb revenue leakages.

Speaking at the launch of the contactless payment platform, FAAN’s managing director said the initiative marks a major upgrade to passenger experience and a significant step toward operational transparency. “This is more than a new payment system; it is a fundamental upgrade to the passenger experience and a powerful reaffirmation of our commitment to transparency and excellence,” she said.

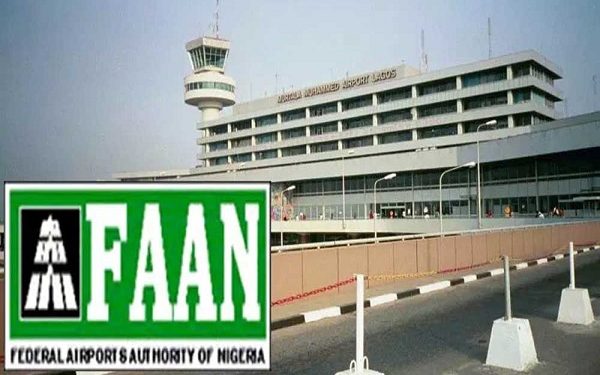

Following a pilot phase in Lagos, the “Operation Go Cashless” policy officially went live in Abuja on September 29, 2025. It will gradually phase out physical cash at all FAAN revenue points, including access gates, car parks, and VIP lounges, with the goal of improving service delivery and revenue collection.

“Our airports are the gateways to our nation. Until now, many of our revenue points — the access gates, car parks, and lounges — have relied on cash, an outdated model that causes delays, operational inefficiencies, and revenue vulnerabilities,” she explained.

The new system allows passengers and airport users to make instant payments with a simple tap using a FAAN Contactless Card. The card operates with a unified wallet, meaning one balance can be linked to multiple registered cards — a feature designed for easy use by families, frequent travellers, and corporate clients. Once registered, the card is valid across all FAAN-managed airports nationwide, including those serving international travellers.

Beyond convenience, FAAN emphasised that the platform prioritises user security. Customers will receive real-time SMS alerts for all transactions and can monitor balances and payment history through a secure online dashboard. Lost or stolen cards can also be blocked instantly through the same platform, ensuring funds remain protected.

The move towards a fully digital payment ecosystem aligns with Nigeria’s broader shift to cashless transactions and reflects efforts to improve operational transparency, boost efficiency, and strengthen revenue systems in public infrastructure. For businesses operating within the airport environment, from transport services to retail outlets, the new system promises faster transactions, better record-keeping, and reduced risks associated with handling cash.