Twenty-three years after its establishment, the Federal Government has opened the application portal for the Cabotage Vessel Financing Fund, unlocking access to vessel financing of up to $25 million per beneficiary for indigenous shipowners.

The long-awaited move is expected to address chronic capacity gaps in Nigeria’s maritime sector, where many local operators, constrained by ageing and undersized vessels, have been excluded from crude oil lifting and other high-value shipping contracts. This has left foreign operators dominating the space, resulting in annual revenue losses running into billions of dollars.

With the launch of the portal, applications are expected to be processed within 70 to 80 days. Approved loans will attract an interest rate of 6.5 per cent and will be repayable over an eight-year tenor, a structure designed to strengthen local shipping capacity and improve Nigeria’s maritime competitiveness.

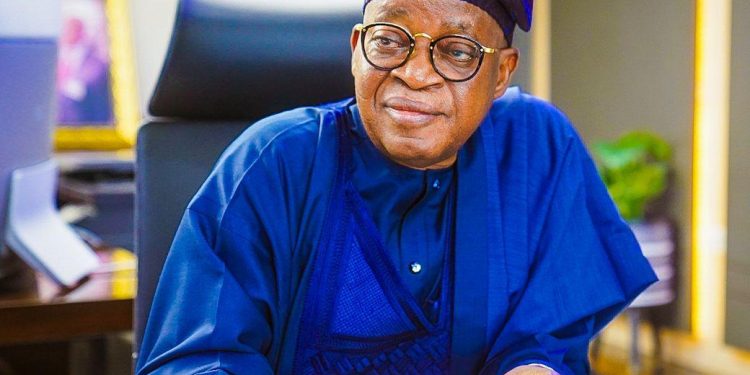

Speaking at the launch, the Minister of Marine and Blue Economy, Adegboyega Oyetola, said the fund has been structured as a revolving facility, requiring beneficiaries to repay loans to sustain access for future applicants. He explained that the overarching objective is to reduce foreign dominance in Nigeria’s shipping industry and create a more competitive environment for indigenous operators.

The portal, which will be managed by the Nigerian Maritime Administration and Safety Agency, allows eligible Nigerian shipowners to submit applications digitally. Oyetola said the digital and rules-based framework was designed to eliminate arbitrariness, opacity, and administrative weaknesses that undermined similar interventions in the past, while restoring confidence among investors, financial institutions, and local operators.

He urged beneficiaries to meet their repayment obligations fully, stressing that the sustainability of the intervention depends on responsible participation. The Minister added that the Ministry, working with NIMASA, the Federal Ministry of Finance, the Central Bank of Nigeria, and other stakeholders, is resolving outstanding issues around the fund in line with international best practices.

The Director General of NIMASA, Dayo Mobereola, said the 6.5 per cent interest rate was agreed after consultations involving the agency, the financial consultant, and Primary Lending Institutions. According to him, the revised rate reflects a deliberate effort to ease the financial burden on indigenous shipowners operating in a capital-intensive industry.

Mobereola noted that shipping requires long-term and patient capital, explaining that the eight-year repayment window was structured to allow operators time to stabilise operations, generate revenue, and meet repayment obligations without excessive pressure. He added that NIMASA has set up a dedicated CVFF unit to oversee implementation, manage applications, coordinate with financial institutions, and enforce strict compliance and risk management standards.

Providing further details on the disbursement process, the Financial Consultant for the CVFF, Buhari Yusuf, said funding would commence within weeks, with key parameters such as funding ratios, interest rates, timelines, and bank participation already defined.

According to Yusuf, the application and structuring phase involving applicants and Primary Lending Institutions, including the preparation of a term sheet and notification to NIMASA, will take a maximum of 30 days. NIMASA’s internal review and issuance of an eligibility certificate, followed by submission to the Minister of Marine and Blue Economy for approval, is expected to take about seven days. Final ministerial approval has been allocated a maximum of 30 days, excluding the time required for applicants to meet conditions precedent for disbursement.

He added that once all conditions are satisfied and a disbursement request is submitted by a Primary Lending Institution, NIMASA will release its portion of the funds within 72 hours, while participating banks are expected to immediately deploy the loans to beneficiaries for vessel acquisition or other approved maritime assets.

Yusuf explained that applicants must submit bankable, transaction-based proposals supported by feasibility studies and provide equity contributions to demonstrate commitment to the projects being financed.

He disclosed that 12 financial institutions have been pre-qualified to participate in the CVFF framework, including Zenith Bank, United Bank for Africa, Union Bank, Taj Bank, SunTrust Bank, Stanbic IBTC, First Bank, Optimus Bank, Lotus Bank, Jaiz Bank, Fidelity Bank, and the Bank of Industry.