Nigeria’s push to digitize tax administration has taken a significant step forward with the accreditation of PwC Nigeria as a system integrator for the country’s mandatory e-invoicing system under the Monitoring, Billing, and Settlement (MBS) platform. The development signals a deeper implementation phase of real-time digital invoicing, with direct implications for micro, small, and medium enterprises (MSMEs) across the country.

The accreditation is part of ongoing efforts by tax authorities to improve transparency, reduce revenue leakages, and strengthen transaction-level tax reporting. Under the MBS framework, businesses are required to transmit invoice data to the National Revenue Service (NRS) platform in real-time, thereby embedding tax reporting directly into their daily business operations.

Partner and Tax & Regulatory Services Leader at PwC Nigeria, Chijioke Uwaegbute, said the move reflects a global shift toward real-time tax oversight and data-driven compliance. According to him, e-invoicing changes how businesses interact with tax authorities by integrating compliance into operational systems rather than treating it as a post-transaction process.

He explained that as transaction data becomes available in real time, organizations must be able to rely on the accuracy and integrity of their invoicing systems for tax reporting, audits, and regulatory reviews. Uwaegbute noted that e-invoicing should not be treated purely as a technology exercise, warning that poor system design could create data gaps and compliance risks.

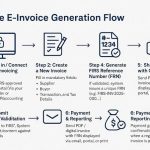

Under the MBS platform, accredited system integrators are responsible for connecting businesses’ invoicing systems securely to the tax authority’s platform. The system replaces traditional paper-based invoicing with digital validation, reducing manual errors and enabling regulators to review transactions as they occur.

For MSMEs, the shift means that invoicing, record-keeping, and tax compliance will increasingly move into automated digital environments. While this may improve efficiency and reduce disputes in the long term, it also raises the need for proper system configuration, accurate data capture, and basic tax compliance awareness among small business operators.

Partner and Tax Technology Leader at PwC Nigeria, Tim Siloma, said the firm would support organizations in reviewing their invoicing and reporting processes, implementing the required integrations, and maintaining compliance as the e-invoicing framework evolves. He stressed that technology alone cannot address compliance challenges without strong tax expertise built into system design.

According to Siloma, effective e-invoicing requires tax rules, data controls, and enterprise systems to work together. He said embedding tax advisory expertise into technology execution helps businesses manage complexity and maintain control as compliance becomes part of everyday operations.

As Nigeria expands the scope of digital tax administration, MSMEs are expected to play a growing role in the formal economy through improved reporting and transparency. The mandatory e-invoicing system marks a shift toward tighter oversight, making it essential for small businesses to understand the new requirements and prepare their operations for a more digitally driven tax environment.