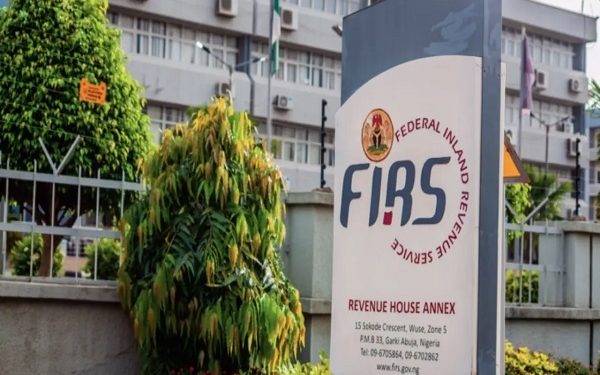

The Federal Inland Revenue Service (FIRS) has introduced a significant relief measure, declaring a complete waiver on accumulated penalties and interests for unpaid tax liabilities. The chairman, Zacch Adedeji, revealed this concession, highlighting the aim to ease the burden on taxpayers and businesses while encouraging adherence to tax laws.

In a statement by Dare Adekanmbi, the special adviser on media, Adedeji emphasized that penalties and interests usually arise due to companies’ inability to meet their tax obligations as required by prevailing tax regulations.

Adedeji acknowledged the challenges faced by many taxpayers in settling their overdue tax liabilities, attributing the waiver to these challenges. He clarified that companies seeking to benefit from this waiver must pay the full outstanding original tax liabilities without any interest by December 31, 2023.

He cautioned that the waiver of interest is contingent upon the complete settlement of the original tax liability before the specified deadline. Any unpaid or partially settled liabilities will lead to the reinstatement of full penalties and interest after the concession window expires.

Expressing gratitude to compliant taxpayers, Adedeji urged them to continue supporting the development of a more responsive and resilient tax system.

Notably, last year, the agency also granted a one-off waiver on all accrued interests and penalties for established tax liabilities through TaxPro Max, valid until December 31, 2022.