Nigeria’s tax administration has entered a new phase of digital reform, with more than 1,000 companies — about 20% of over 5,000 eligible firms — beginning integration with the Federal Inland Revenue Service’s (FIRS) newly launched electronic invoicing platform.

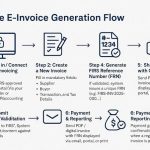

The platform, which went live on August 1, is designed to streamline tax compliance, improve transparency, and curb tax evasion. It represents one of the most significant steps in modernizing the country’s fiscal systems.

According to the FIRS, the e-Invoicing system follows a successful pilot phase that started in November 2024 and is being rolled out in stages, beginning with large taxpayers — firms with annual turnovers of N5 billion and above.

In under two weeks of launch, major corporations have begun embracing the system. MTN Nigeria became the first to transmit live e-invoices, marking the official start of the new regime. Huawei Nigeria and IHS Nigeria have also completed successful test transmissions and are preparing to go live.

To aid smooth onboarding, FIRS is working with the National Information Technology Development Agency (NITDA) to bring service providers into the system as System Integrators and Access Point Providers. These providers will help companies integrate with the platform and handle invoice transmissions.

While many firms attempted to meet the initial August 1 deadline, some faced operational challenges. As a result, the final onboarding deadline has been extended by three months to November 1, 2025. The tax agency says it will maintain stakeholder engagement through webinars, workshops, and town hall meetings to help companies make the transition.

The e-Invoicing solution, developed as part of the Electronic Fiscal System (EFS), offers real-time tracking of commercial transactions and ensures invoices are authentic, accurate, and complete. It aligns with global best practices and supports Nigeria’s broader goals of boosting revenue assurance, tackling tax evasion, and unifying revenue reporting under the Nigeria Revenue Services Reform Act.

Following the integration of large taxpayers, the system will be extended to medium-sized and emerging businesses, widening its coverage and economic impact.

FIRS commended taxpayers, consultants, and service providers for their cooperation, describing the e-Invoicing platform as a transformative milestone in the country’s fiscal history.