The Federal Inland Revenue Service (FIRS) has unveiled 16 technology companies as certified service providers to support taxpayers in adopting its new e-invoicing platform.

The companies, certified by the National Information Technology Development Agency, will serve as system integrators and access point providers, assisting taxpayers with onboarding, system integration, and invoice transmission processes. The unveiling took place during a two-day workshop in Lagos.

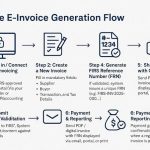

According to FIRS, the National E-Invoicing Solution (Merchant-Buyer Model) is a digital replacement for traditional invoices, credit notes, and debit notes. The system captures essential transaction details, including supplier and buyer information, item descriptions, quantities, prices, tax, and total amounts. It is designed to validate and store transactions in real time or near-real time, enhancing transparency and efficiency.

The Acting Director of Tax Automation at FIRS said taxpayers are free to switch providers if dissatisfied with services and assured that the list of approved providers will be continuously updated. “If we find any provider in breach of conditions, they will be removed,” he stated.

The certified firms include Pasca Technology Limited, Hoptool Technology Limited, Etranzact International Plc, Telepac Africa Nigeria Limited, Cryptware System Limited, Namiri Technology Nigeria Limited, Ace of Spades Consult Nigeria Limited, Jureb Business Solutions Limited, Qucoon Limited, Courteville Business Solutions, Softrust Technologies Limited, Westmetro Limited, Arca Payments Company Limited, Elara Technical Services Limited, Interswitch Limited, and Remita Payment Limited.

In his opening remarks, the Chief of Staff to the FIRS Executive Chairman, represented at the event, disclosed that over 1,000 companies have already been onboarded since the platform went live on August 1, 2025. However, this represents only 20 per cent of the target, with more than 5,000 companies expected to join.

Three major firms—MTN, IHS, and Huawei—have become the first companies to go live on the platform. While acknowledging progress, the FIRS extended the onboarding deadline by three months, setting a new compliance date of November 1, 2025.

“This extension is not an opportunity to delay. It is a call for businesses to complete the process and ensure full compliance,” the FIRS official emphasised.

The e-invoicing platform is expected to streamline tax administration, improve compliance, and provide businesses with a transparent digital record of their transactions.

![Call For Applications:Innova [Africa Future of Work and Entrepreneurship] Fellowship 2023 Innova [Africa Future of Work and Entrepreneurship] Fellowship 2023](https://msmeafricaonline.com/wp-content/uploads/2023/07/WhatsApp-Image-2023-07-03-at-8.01.03-AM.jpeg)