FSA joins Africa Development Bank and Africa Reinsurance Corporation under ‘Class-B’ shareholding category.

Niamey-based Fonds de Solidarite Africain (FSA) has become the 47th shareholder of Shelter Afrique after paying 1 billion FCFA (approx. US$2 million) in capital subscription, granting it 0.6% stake in Company, the pan –African housing development finance disclosed Tuesday.

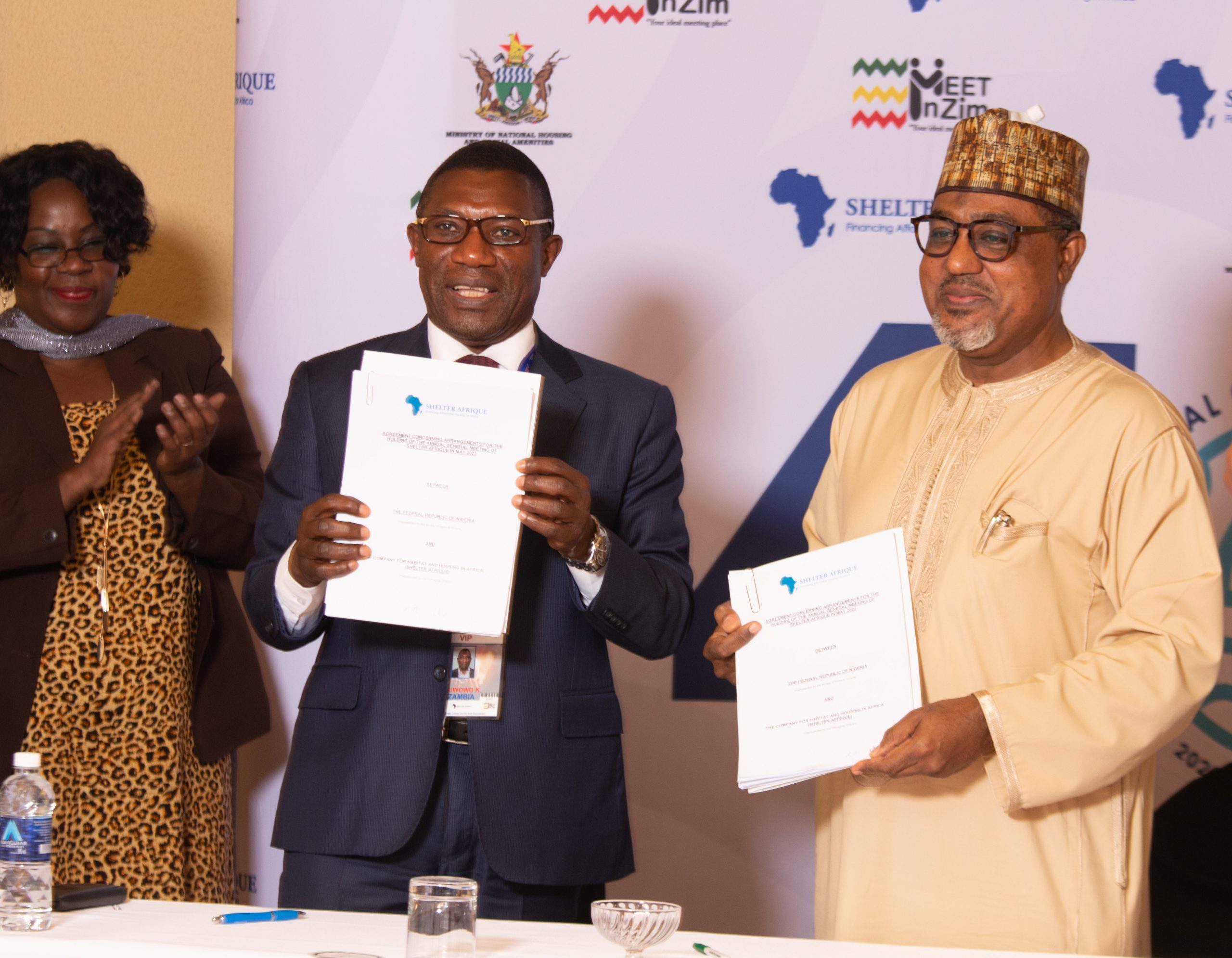

Speaking at the signing of the Pledge of Subscription and the Instrument of Adherence by FSA in Nairobi, Shelter Afrique Chairman Dr. Steve Mainda said the decision to admit Fonds de Solidarite Africain as a shareholder followed the unanimous approval by shareholders at the Company’s 40th Annual General Meeting held in June, in Yaoundé, Cameroon.

“I wish to thank the General Assembly for passing the resolution to admit FSA as our 47th Shareholder. I also wish to thank the management and staff of Shelter Afrique for delivering on the objectives set by the board. Lastly, let me thank the FSA for identifying a joint vision and sharing our zeal for developing Africa and especially providing financial services to propel African economies,” Dr. Mainda said.

In recent past Shelter Afrique has intensified capital subscription receipts from current shareholders and at the same time mobilised heighted drive for recruitment of new shareholders.

“We are happy to welcome Fonds de Solidarite Africain to the Shelter Afrique family. This is a remarkable milestone that gives us assurance and great comfort that our vision of providing decent and affordable homes to all Africans is one that is not only shared by others but is worthy and necessary,” Shelter Afrique Group Managing Director and CEO Andrew Chimphondah said.

Fonds de Solidarite Africain was established in December 1976 with the mission of facilitating the economic development of its African member states by acting as a catalyst by enabling access to loans for productive investment projects and by facilitating the mobilization of local and external savings through guarantee interventions.

“Fonds de Solidarite Africain’s pan-African outlook, vision and mission are similar to those of Shelter Afrique and we are happy that we are now part of Shelter Afrique family. The interventions techniques of the two institutions are complementary and we are looking forward to working together to address various issues infecting African population, more importantly, financing of affordable housing in Africa. Our ultimate goal is to acquire permanent seat in Shelter Afrique Board,” Fonds de Solidarite Africain Managing Director Mr. Ahmadou Abdoulaye Diallo said.

Share categories

Shelter Afrique’s share capital is held by two groups of shareholders made up of 44 African countries including Algeria, Benin, Botswana, Burkina Faso, Cameroon, Cape Verde, Central Africa Republic, Chad, Congo, Côte d’Ivoire, Democratic Republic of Congo, Djibouti, Gabon, Gambia, Ghana, Guinea Conakry, Guinea Bissau, Equatorial Guinea, Ivory Coast, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Namibia, Niger, Nigeria, Rwanda, Sao Tome & Principe, Senegal, Seychelles, Sierra Leone, Somalia, Swaziland, Tanzania, Togo, Tunisia, Uganda, Zambia, and Zimbabwe, in ‘Class A’; and African Development Bank (AfDB) and the African Reinsurance Corporation (Africa-Re) in ‘Class B’.

Fonds de Solidarite Africain now joins Africa Development Bank and Africa Reinsurance Corporation under ‘Class-B’ shareholding category.

“Our goal is to onboard the remaining 10 African countries that are not yet members of this great pan-African development finance institution with immediate focus on South Sudan, Egypt, South Africa, and Ethiopia. We are also working towards enrolling more Africa indigenous companies under “Class-B” category and expanding further our shareholding to accommodate other non- African investors under “Class-C” shareholding, which we have already created,” Mr. Chimphondah concluded.

Shelter-Afrique is a pan African housing finance and development institution established by African governments to address the need for a sustainable housing delivery system and related infrastructure projects in Africa. Shareholders include 44 African countries, the African Development Bank, and the African Re-Insurance Corporation.