According to its chief executive, a new Ghanaian government-owned development bank plans to lend $600 million to small firms over the next one to two years to assist meet credit demand and contribute to growth in the inflation-plagued west African country.

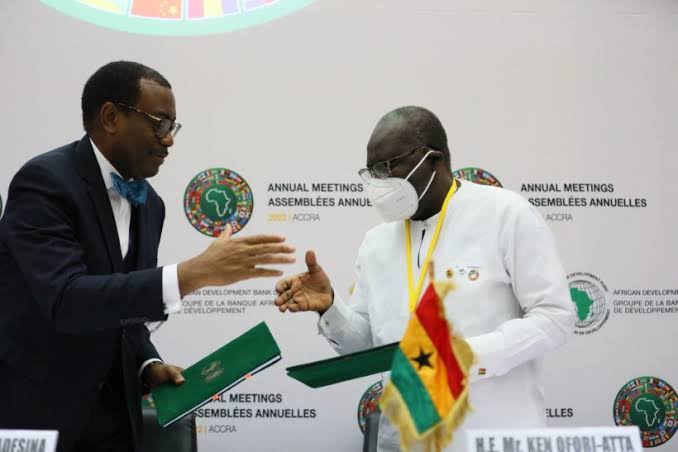

The World Bank, Germany’s KfW development bank, the European Investment Bank (EIB), and the African Development Bank (AfDB) have all contributed money, according to the Development Bank of Ghana’s CEO Kwamina Duker, who spoke to Reuters ahead of the bank’s official opening on Tuesday.

In Ghana, businesses with fewer than 100 employees had a hard time getting loans, with a World Bank analysis suggesting that the supply-demand imbalance was equivalent to 13% of GDP in 2017.

“(There is) very little long-term financing available, at rates that will allow our SMEs (small and medium enterprises) to grow,” Duker said.

Ghana’s government owns DBG and has invested $250 million in the company. The African Development Bank will provide $40 million, the World Bank will lend $200 million, and the EIB and KfW will provide 170 million euros ($177.7 million) and 46.5 million euros, respectively.

Duker said it would lend commercial banks between $5 million and $30 million, with four banks already on board: CalBank (CAL.GH), Consolidated Bank Ghana, Fidelity Bank of Ghana (FIDELIT.LG), and GCB Bank (GCB.GH).

Small businesses would then receive three to fifteen year loans ranging from $25,000 to $3 million from these banks.

DBG’s goal, which presently employs 40 people, is to increase the percentage of loans issued to small businesses in Ghana from roughly 9% to 15% in two years, according to Duker.

Duker wouldn’t say what the interest rates would be, but he did say they’d be lower than what’s now offered commercially. In May, Ghana’s inflation rate hit a new 18-year high of 27.6%, prompting a 200-basis-point raise in interest rates to 19 percent in an attempt to cool prices.

“Is this a difficult time? Absolutely,” Duker said. “Is this a time when a development bank is needed more than ever? Absolutely.”