InfraCredit has secured a $30 million risk-sharing and blended local currency co-financing facility from the British International Investment (BII), the UK’s development finance institution. This investment aims to accelerate Nigeria’s clean energy transition, particularly through decentralized renewable energy (DRE) projects.

The $30 million consists of a dual financing structure: $20 million (N32 billion) in local currency counter-guarantees and $10 million (N16 billion) in concessional financing. This financing will support the development of DRE projects, backed by InfraCredit’s ‘AAA’ rated infrastructure credit guarantee services. The concessional financing is provided through the Climate Finance Blending Facility (CFBF), a catalytic first-loss multi-donor facility aimed at unlocking further funding from development partners and domestic institutional investors.

BII’s Commitment to Nigeria’s Energy Sector

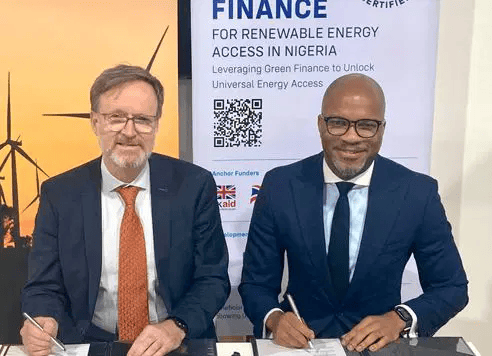

Richard Montgomery CMG, British High Commissioner to Nigeria, praised the success of the Climate Finance Blending Facility, which has mobilized $11.48 million (N8.92 billion) for rural mini-grids and solar-powered telephony projects. He emphasized that the latest investment would amplify the impact of these efforts, furthering Nigeria’s clean energy progress.

Benson Adenuga, Head of Office and Coverage Director, Nigeria at BII, stressed that expanding distributed renewable energy in Nigeria is crucial not only for environmental reasons but also for enhancing economic resilience and reducing the reliance on costly diesel fuel. He noted that decentralized clean energy offers a reliable, scalable, and sustainable solution for Nigeria’s growing energy demand.

Chinua Azubike, CEO of InfraCredit, highlighted the significance of the collaboration with BII, explaining that the innovative investment structure would help de-risk projects, reduce capital costs, and encourage local institutional investments in renewable energy infrastructure.

The investment is expected to mobilize additional private capital, reduce the risk profile of DRE projects, and lower the cost of local currency debt for developers. This, in turn, will help reach low-income customers in Nigeria with affordable and reliable energy solutions.

InfraCredit’s growing pipeline of DRE projects has now reached $497.37 million (N746.05 billion) and is projected to expand further in the coming years. The new facility is expected to provide over 57,000 new energy connections, increase renewable energy capacity by 20.1 MWp, and create over 2,500 jobs while reducing greenhouse gas emissions by 158.3 tonnes.

Nigeria faces the world’s largest energy access deficit, with over 85 million people—43% of the population—lacking access to electricity. Many regions in the country have electrification rates as low as 31%, highlighting the urgent need for DRE solutions. The investment from BII will improve the quality of life for rural and low-income communities by providing more reliable power and reducing dependence on diesel-powered generators.

This partnership between InfraCredit and BII represents a significant step in addressing Nigeria’s energy access challenges and advancing the country’s clean energy transition.