According to leading audit and professional services company, KPMG Nigeria, Ecobank Nigeria is among the top three banks with good customer experience in the SME segment.

KPMG’s Nigeria banking industry customer experience survey measures the performance of lenders in the country in terms of their relationship with their account holders and other users of financial services.

The 2020 survey covered 15,056 retail customers, 1,856 SMEs and 332 commercial/corporate organisations. Respondents were selected from customers who have interacted with their bank in the last six months.

According to the report in the SME category, Sterling Bank, Union Bank and Ecobank were top three.

They were trailed by Zenith Bank and FCMB. Specifically, the report stated that respondents were impressed with the interaction between Ecobank and its customers during the COVID-19 pandemic lockdown, stressing that the bank was able to provide personalized service to its respective customer segments.

“The remote working arrangements resulting from the COVID-19 pandemic have further constrained banks from catering to this stated need. While many banks struggled with providing dedicated relationship managers to SMEs, other banks quickly adapted by developing “how-to” guides for their relationship managers to navigate client relations during the pandemic. Ecobank, FCMB and Union Bank are rated as the top banks in the delivery of personalised experiences”. The report stated.

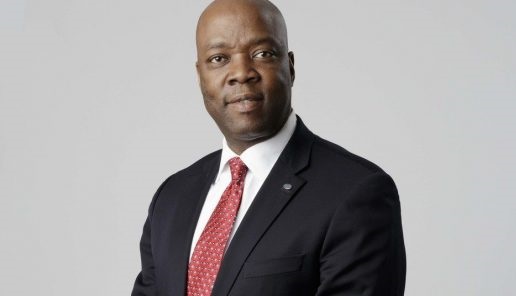

Commenting, Patrick Akinwuntan, Managing Director, Ecobank Nigeria, stated the bank’s unwavering commitment to support and sustain the development of Small and Medium Enterprises (SMEs) in all sectors of the economy.

He reiterated that Ecobank had invested in a robust technology-based model which positioned it to cope with current and future challenges including provision of convenient digital banking services to customers in a seamless manner, adding that the bank will continue to harness and explore the various intervention schemes, funding and trade opportunities for small businesses.

“We are delighted with this recognition from KPMG. It underscores our commitment to customer-centricity and putting the customer first in all that we do. We provide access to finance and markets to our customers and are the natural choice for ease of payments, trade and distribution within Africa on a real time, 24/7 basis.

“Our well trained personnel leverage the financial products and services we offer to support SMEs at all times through about 20,000 agency banking locations across the country and our digital platforms namely Ecobank Omnilite, Ecobankmobile, Ecobankpay, EcobankOmniplus, Rapid Transfer amongst others.

By utilising these digital offerings, our customers can easily access their bank accounts, make payments, transfer funds, process salaries, have access to credit and carry out other ancillary banking transactions from the comfort of their homes and offices”. Mr Akinwuntan stated.

The KPMG 2020 Nigeria Banking Industry Customer Experience Survey tagged: The customer in a new reality is the 14th edition. Banks are usually rated in three categories – Retail, SME and Wholesale.

The researchers asked customers across financial market segments about their experience with their banks based on six pillars of personification, integrity, expectations, time and effort, resolution and empathy.