The President of the Regional Maritime Development Bank (RMDB) has called on African nations to urgently confront the deep structural and financial barriers that continue to hold back the continent’s mining sector, despite its immense mineral wealth.

Speaking at a high-level panel during the African Development Bank (AfDB) Annual Meetings in Abidjan, Côte d’Ivoire, the RMDB President warned that without bold domestic action, Africa risks missing a historic opportunity to lead in the global energy transition. He said Africa’s abundant resources — including cobalt, lithium, graphite, and manganese — place the continent at the heart of global decarbonisation and electrification efforts, but systemic weaknesses continue to trap this potential underground.

He identified four persistent challenges weakening the sector: the chronic shortage of early-stage financing, the lack of reliable geological data, weak project development pipelines, and the absence of integrated infrastructure. These gaps, he said, are not merely technical obstacles but fundamental constraints that have prevented Africa from becoming a competitive player in the global mining economy.

“Our challenge is not resource scarcity but productivity. Africa’s minerals remain untapped because we have failed to build a financing and governance ecosystem strong enough to move projects from exploration to development,” he said.

While interest is growing among African banks to fund downstream projects such as processing and manufacturing, he pointed out that the upstream segment — where exploration and discovery begin — remains largely starved of local capital. The risks are considered too high, and the returns too uncertain. Without the right tools to reduce this risk, he argued, local financial institutions will continue to avoid early-stage mining investments.

To reverse this trend, he proposed a series of financial strategies designed to unlock domestic capital. These include the use of mining bonds, securitization of mineral royalties, and blended finance models that combine public and private funding. He also called for the establishment of risk-sharing tools and government-backed credit enhancements that would help ease the reluctance of local banks.

Beyond financing, he emphasized the need for stronger public-private partnerships and for African governments to take an active role in preparing viable, bankable mining projects. He argued that finance ministries must lead with fiscal incentives and that central banks should adopt policies that actively support domestic mining finance.

He said Africa must stop depending solely on foreign capital to drive its resource economy. “Mobilising domestic capital is not just an economic imperative — it is a sovereign necessity,” he declared.

This call to action comes as demand for critical minerals surges globally. He cited projections showing that the value of the global market for minerals such as copper, lithium, cobalt, and rare earths is expected to more than double — from $325 billion in 2023 to $770 billion by 2040 — with copper leading the growth due to its essential role in green infrastructure and technologies.

Africa already holds a dominant share of global reserves for many of these minerals. The continent hosts two-thirds of the world’s cobalt, 30 percent of lithium, and 20 percent of graphite, along with significant manganese and bauxite deposits. Yet, the continent continues to export most of these resources raw, leaving value addition and job creation to countries outside Africa.

He warned that without a radical shift from extraction to industrialisation, Africa risks repeating a history of dependency. “The real wealth lies not in the minerals themselves but in processing them, creating local industries, jobs, and sustainable economies,” he said.

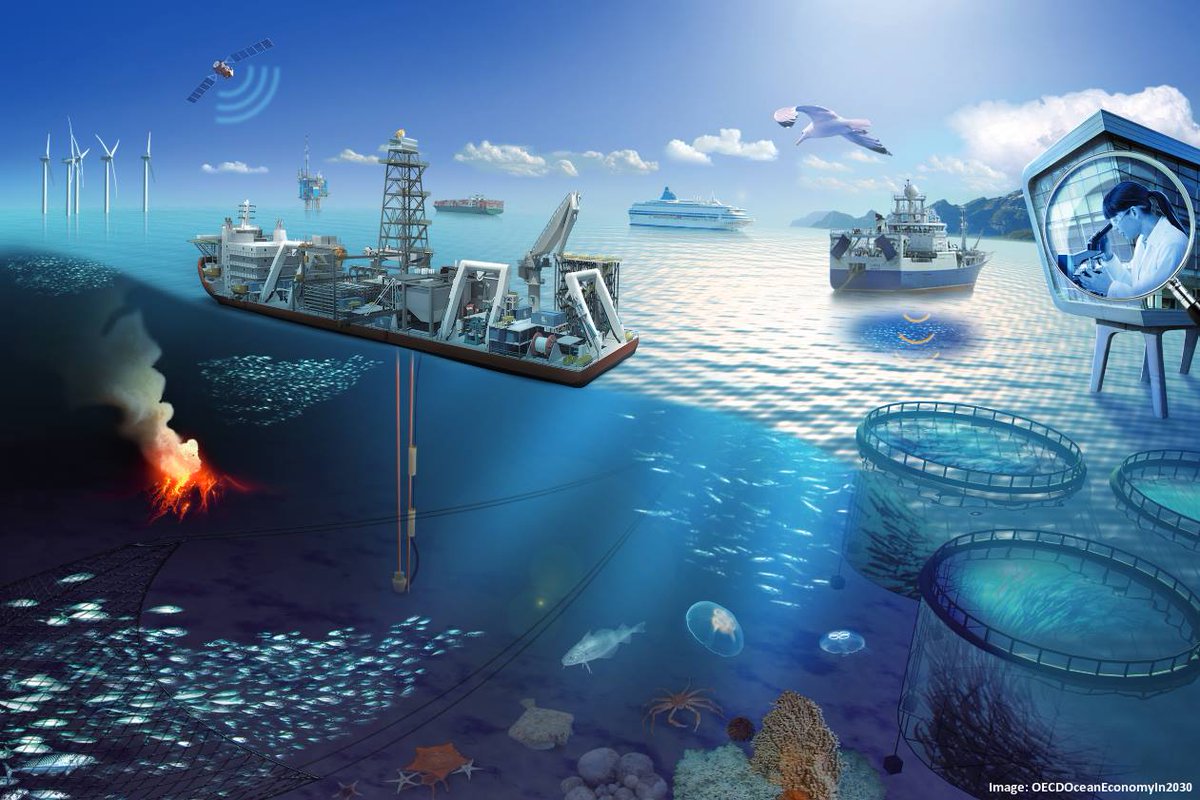

He also stressed the strategic role of maritime infrastructure in realizing this transformation. Efficient sea transport, he said, is essential to the success of Africa’s mineral-to-industry strategy. By improving seaborne trade links and connecting landlocked and coastal countries through better logistics, Africa can unlock intra-continental trade and reduce dependence on external trade corridors and volatile global pricing systems.

“Minerals must lead to value-added goods — batteries, machinery, components — which can be traded within Africa and exported through our ports,” he said, adding that maritime logistics are a central pillar of RMDB’s long-term development vision.

The RMDB President also urged international investors to contribute to local capacity building, rather than perpetuate Africa’s role as a raw material supplier. Global partnerships, he said, must serve the continent’s broader interest of value chain development and industrialization.

He concluded by calling for unity and urgency among African governments and institutions, noting that in a century defined by climate action and technological disruption, Africa’s mineral resources could be its passport to long-term prosperity — if the continent can find the collective will to finance and develop its own future.

“Africa must rise to this moment — with resolve, with investment, and with an integrated strategy that links land, industry, and sea,” he said.