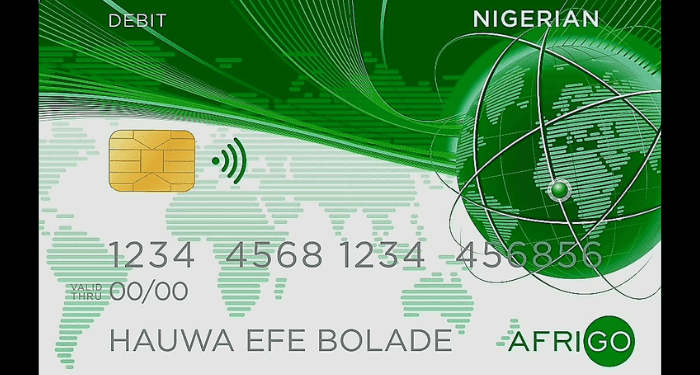

Moniepoint Inc. has announced a strategic partnership with Afrigopay Financial Services Limited (AFSL), a subsidiary of the Nigeria Inter-Bank Settlement System (NIBSS), to distribute five million AfriGO cards to Nigerians. This initiative is expected to accelerate the adoption of Nigeria’s National Domestic Card Scheme and strengthen the government’s digital payment agenda.

With this collaboration, Moniepoint will leverage its extensive network and infrastructure to facilitate the AfriGO card’s tap-and-pay functionality. This feature allows users to make payments simply by tapping or hovering their contactless card or Near Field Communication (NFC)-enabled device over a payment terminal or a compatible mobile phone. The goal is to provide Nigerians with a more seamless, secure, and efficient payment experience, especially in areas with limited financial infrastructure.

Speaking on the partnership, Afrigopay CEO Ebehijie Momoh emphasized that the initiative would significantly improve financial services across the country, particularly in underserved communities. She explained that the AfriGO card offers merchants and agents a streamlined transaction process with instant settlements, reducing operational risks and enhancing cash flow management.

Momoh also pointed out that the initiative would help reduce Nigeria’s reliance on foreign exchange (FX) for payment transactions while ensuring data sovereignty. By promoting the use of a locally issued payment card, the AfriGO scheme empowers Nigerian businesses and strengthens the domestic financial ecosystem.

Moniepoint CEO Tosin Eniolorunda expressed confidence in the potential of contactless payments to transform Nigeria’s financial landscape. He noted that the partnership aligns with Moniepoint’s vision of fostering financial inclusion by making digital transactions more accessible to individuals, businesses, and financial institutions.

“The benefits of contactless payments are far-reaching and will be great for our ecosystem. There are mutual synergies in unlocking potentials by creating a better life through our services for all Nigerians. Together, we can reshape the digital economy so that individuals, financial institutions, governments, and businesses can realize their ambitions,” Eniolorunda stated.

The AfriGO card initiative was introduced in January 2023 by the Central Bank of Nigeria (CBN) in partnership with NIBSS to enhance financial inclusion and provide Nigerians with a local alternative to international card networks. At its launch, the then-CBN Governor, Godwin Emefiele, highlighted that the AfriGO card was specifically designed to address local challenges that existing foreign card products had not fully catered to.

With this initiative, Nigeria joins other nations, including China, Russia, Turkey, and India, that have developed their own domestic card schemes. While the AfriGO card does not replace international cards, it provides Nigerians with additional options for payment, particularly in domestic transactions.

Beyond this initiative, Afrigopay is also working with the National Identity Management Commission (NIMC) to introduce a general multipurpose card that integrates payment functionality with national identity. This further underscores Nigeria’s broader effort to build a more robust, secure, and self-sufficient financial system.

By distributing millions of AfriGO cards nationwide, Moniepoint and Afrigopay are taking a significant step toward deepening digital payments, empowering businesses, and ensuring more Nigerians have access to modern financial services.