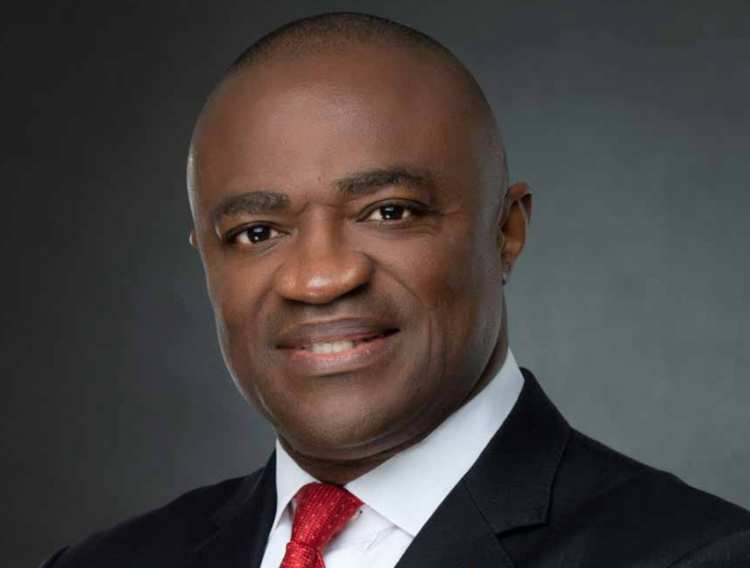

The Group Managing Director/Chief Executive Officer of United Bank for Africa (UBA) Plc and Chairman of the Body of Bank CEOs, Mr. Oliver Alawuba, has warned that the country’s banking sector may be unable to confidently extend credit without a functional and efficient judicial system.

He gave the warning as non-performing loans continue to rise amid judicial delays and enforcement bottlenecks.

He said this during the opening of the 23rd National Seminar on Banking and Allied Matters for Judges. The seminar, jointly organised by the Chartered Institute of Bankers of Nigeria (CIBN) and the National Judicial Institute (NJI), was held at the NJI headquarters in Abuja.

According to Alawuba, the country’s financial system is exposed to systemic risk due to the judiciary’s current limitations in handling commercial and financial disputes. He drew attention to the over N1.57 trillion in non-performing loans in the banking sector, describing it as a symptom of deeper institutional weaknesses that need to be addressed.

Without a strong, efficient judiciary, banks will struggle to extend credit with confidence. Our partnership is not one of convenience, but of necessity,” he warned.

He called for urgent reforms to enhance judicial performance in financial matters, including digitisation of court processes, investment in judicial capacity building, and the establishment of specialized financial courts to handle complex cases involving fraud, cybercrime, and contract enforcement.

Alawuba said the banking industry’s success is tied to the effectiveness of the courts. “No economy can flourish without the enabling guardrails of justice. From credit systems to contract enforcement, the banking industry depends daily on the efficiency, fairness, and predictability of our judicial processes,” he said.

He argued that the courts must evolve to meet the demands of a rapidly transforming financial landscape, especially as digital platforms, fintech innovation, and cybercrimes become more entrenched in Nigeria’s financial ecosystem.

Echoing Alawuba’s call for reform, the Chief Justice of Nigeria, Justice Kudirat Kekere-Ekun, stressed the strategic importance of judicial predictability in promoting economic growth.

“Judicial predictability is not just a legal virtue – it is an economic asset. It enhances market efficiency, lowers risk premiums, and unlocks capital for infrastructure and business development,” Justice Kekere-Ekun said in her opening remarks.

She urged members of the bench to constantly update their knowledge in emerging fields of financial regulation and digital commerce. “Our courts must possess the capacity to interpret complex transactions and assess novel financial arrangements within the framework of existing laws,” she added.

On the part of the Chartered Institute of Bankers of Nigeria, the President and Chairman of Council, Professor Pius Olanrewaju, described trust and security as central pillars of banking, maintaining that the role of the judiciary cannot be separated from the stability of the banking system.

“Trust is the lifeblood of banking, and security its bedrock. Every financial transaction, from deposits to loans, hinges on the assurance that rights will be upheld, obligations fulfilled, and injustices addressed,” Olanrewaju said.

He maintained that courts must inspire confidence in the resolution of financial disputes and protect the sanctity of contracts, as failure to do so could undermine investor confidence and hinder the nation’s economic growth.

Administrator of the National Judicial Institute, Hon. Justice Salisu Abdullahi, also linked judicial efficiency to national development, saying that a competent and independent judiciary is fundamental to investor confidence and economic stability.

“A judiciary that is both competent and fiercely independent doesn’t just resolve disputes; it actively underwrites economic growth. It creates the fertile ground where capital feels safe to land, innovation can flourish, and businesses can thrive,” he said