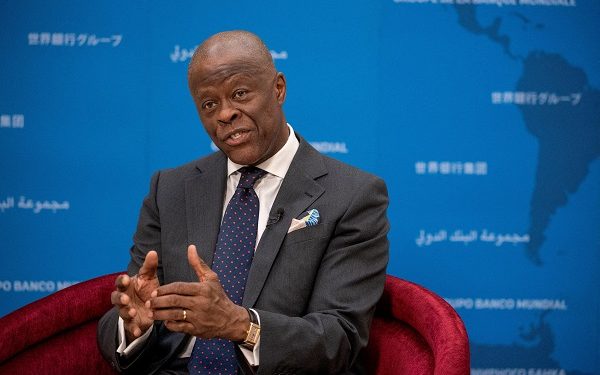

Nigeria’s Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has signalled that interest rate cuts could be on the horizon if inflation continues to moderate, a shift that could lower debt-servicing costs and ease mounting pressure on the country’s public finances.

Edun made the comments in an interview on the sidelines of the Abu Dhabi Sustainability Week, according to Bloomberg, at a time when Nigeria’s budget is strained by high borrowing costs, volatile oil revenues and a widening fiscal deficit. Any reduction in interest rates would be materially significant for government finances, given the scale of debt servicing obligations.

He praised the Central Bank of Nigeria for what he described as strong progress in tackling inflation, attributing recent improvements to aggressive monetary tightening carried out over the past two years. During that period, the CBN more than doubled its policy rate from 2022 levels in a bid to rein in rising prices, before easing slightly with a 50 basis-point cut in September that brought the benchmark rate to 27 per cent. The adjustment followed a sharp moderation in inflation from its late-2024 peak.

According to Edun, a sustained decline in inflation would open the door to further rate cuts, helping to reduce borrowing costs across the economy and easing the government’s debt servicing burden. He said lower inflation and cheaper borrowing would free up revenue currently spent on interest payments and improve Nigeria’s overall fiscal balance.

Nigeria’s fiscal outlook remains under significant pressure. In the proposed 2026 budget, more than a quarter of the N58 trillion spending plan is earmarked for interest payments, estimated at about N40 billion. Projected revenues stand at around N34 trillion, constrained largely by weak oil receipts, leaving a budget deficit of roughly N24 trillion, or about 4.3 per cent of GDP, wider than the estimated gap recorded the previous year.

For businesses, especially MSMEs, a lower interest rate environment could ease access to credit and reduce financing costs, supporting investment and economic activity. At the macro level, reduced debt servicing would also give the government more fiscal breathing room at a time when deficits are widening and revenue sources remain under pressure.

Edun said the government’s borrowing strategy would remain flexible and market-driven, with decisions on domestic and external issuances guided by pricing, timing, investor appetite and compliance with debt limits set out in the medium-term expenditure framework. He added that beyond monetary policy, the administration is stepping up efforts to boost revenue mobilisation and reduce reliance on borrowing through structural reforms and improved efficiency in revenue collection.

As part of these efforts, the government is rolling out directives requiring ministries, departments and agencies to stop cash collections and migrate fully to automated payment platforms to improve transparency and curb leakages. Authorities are also counting on privatisation proceeds, divestments by the Nigerian National Petroleum Company and higher crude oil production to support budget funding as Nigeria navigates a challenging fiscal environment.