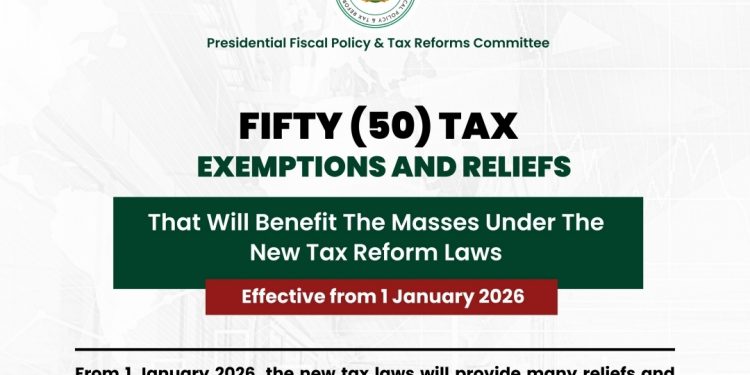

Nigeria will introduce 50 tax exemptions and reliefs from January 1, 2026, to support low-income earners, average taxpayers, startups, and small businesses. The plan, announced by the Presidential Fiscal Policy and Tax Reforms Committee, focuses on reducing tax pressure, boosting business growth, and improving fairness in the Nigerian tax system.

A New Chapter for SMEs and Low-Income Earners

Small businesses and everyday earners often struggle with heavy taxes and compliance stress. The new tax rule rollout offers major relief that will help entrepreneurs, workers, and small firms keep more income, invest in growth, and operate with confidence.

The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, confirmed that the new reforms aim to make tax rules clearer, more friendly to honest taxpayers, and more supportive of national growth.

Key Wins for Small Businesses and Startups

Below are the most important tax exemptions that Nigerian SMEs, startups, and everyday taxpayers can expect from 2026.

Development Levy Relief

Small companies will not pay the 4 percent development levy.

This helps micro businesses reduce fixed costs and stay operational during the early growth phase.

Withholding Tax Relief

Small companies, manufacturers, and agribusinesses will enjoy exemptions from:

- Withholding tax on income

- Withholding tax on payments to suppliers

This means better cash flow for small firms, leading to easier day-to-day operations and fewer tax deductions on earnings.

VAT (Value Added Tax) Exemptions

0 percent VAT or exemption on essential products and services, including:

- Basic food items

- Rent

- Education materials and school services

- Medical services and pharmaceuticals

- Agricultural inputs

- Baby products and sanitary pads

- Humanitarian aid supplies

Also:

Businesses earning below ₦10 million yearly do not need to charge VAT.

This directly supports micro-enterprises and low-margin businesses.

Stamp Duty Exemptions

No stamp duty on:

- Transfers below ₦10,000

- Salary payments

- Money transfers within the same bank

- Share transfer documents

This protects individuals and small investors from extra bank fees.

Capital Gains Tax (CGT) Exemptions

No tax on:

- Sale of a personal house lived in by the owner

- Personal items worth up to ₦5 million

- Sale of up to two private cars in a year

- Share gains below ₦500 million per year or up to ₦10 million

- Shares above the limit if proceeds are reinvested

- Charities, pension funds, and religious bodies (non-commercial activities only)

Companies’ Income Tax (CIT) Exemptions

Small companies will pay 0 percent income tax if they have:

- Annual turnover not more than ₦100 million

- Total fixed assets not more than ₦25 million

Also included:

- Registered startups that qualify under government innovation programs

- Extra deduction of 50 percent for salary increases, bonuses, and wage support for low-income workers

- 50 percent deduction for salaries of new staff employed and retained for at least 3 years

This rewards job creation and helps new founders ease into operations.

Why These Reforms Matter

These policies bring real support to Nigeria’s backbone economy. MSMEs make up over 90 percent of businesses in the country, and many operate on slim margins. With reduced tax pressure, owners can:

- Hire more workers

- Expand products or services

- Improve technology and systems

- Support community-level economic growth

This reform also moves Nigeria toward a simpler and fairer tax system that supports young innovators, growing SMEs, and everyday workers.

What Nigerian Businesses Should Do Now

- Study these changes early

- Update your financial records

- Work with tax professionals to prepare

- Take note of your company category and revenue level

- Get your business formally registered to qualify for incentives

Tip: Read How the 2025 Nigerian Tax Reform Acts Will Impact MSMEs: What You Need to Know here:

Frequently Asked Questions (FAQs)

1. When will these tax exemptions start?

January 1, 2026.

2. Who benefits from this tax reform?

Low-income earners, startups, micro-businesses, and small companies.

3. Will small companies pay company income tax?

No. Businesses with revenue below ₦100 million and assets below ₦25 million will pay 0 percent CIT.

4. Do small entrepreneurs still need to register for VAT?

No. If your business earns less than ₦10 million a year, you do not need to charge VAT.

5. What relief is available for hiring workers?

Businesses get 50 percent tax deductions for salary increases and for new employees kept for three years.

6. Is stamp duty gone?

It still applies, but small payments, salary transfers, and internal bank transfers are exempt.

7. Does this reform help tech startups?

Yes. Registered and labelled startups will get tax exemptions and incentives.

This reform brings a big shift for SMEs in Nigeria. By reducing tax pressure and supporting job creation, it gives small entrepreneurs more room to grow and compete. Business owners should prepare early to make the most of these opportunities.