Nigeria’s e-commerce startup TradeDepot, which connects international brands to small businesses in Africa, has raised $10 million during a new round of funding to expand its business into financial services and credit offerings for retailers.

Nigeria’s e-commerce startup TradeDepot, which connects international brands to small businesses in Africa, has raised $10 million during a new round of funding to expand its business into financial services and credit offerings for retailers.

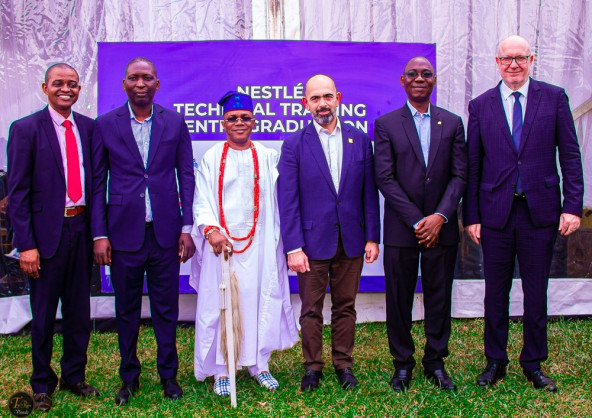

First launched in 2016, TradeDepot has built a network of 40,000 small businesses in Nigeria and connects them to local distributors of worldwide consumer brands like Nestlé, Unilever, GB Foods and Danone, consistent with a press release.

The initial business model managed to draw in a $3 million investment led by Partech back in 2018. And now, because the firm invests from its largest African fund, Partech returned to co-lead TradeDepot’s latest round with the International Finance Corp., Women Entrepreneurs Finance Initiative and MSA Capital.

TradeDepot’s business depends on making a variety of household supplies like milk, soap, and detergent more accessible and affordable for the street-side vendors and little shops that provide goods and services for many communities in cities like Lagos — where the startup is headquartered.

Using the company’s mobile apps on Android or Whatsapp, USSD short code messaging or a toll-free telephone number, retailers can place orders and have goods and services delivered through TradeDepot’s fleet of vans and tricycles. They will make payments, order stock, and manage inventory online or through the app also.

For consumer brands, they need a central hub through which to distribute on to vendors on the continent, along with side data which will help them manage their relationship with these small vendors.

“Africa’s offline retail market is estimated at $1 trillion, and this new investment allows us to capture a good greater segment of that market,” said Onyekachi Izukanne, in a statement.

“We will still use data to drive efficiencies and supply a neater stock acquisition service for our [over] 40,000 retailers, driving down costs for them by negotiating even better deals with our global manufacturing partners, while simultaneously providing a far better, faster route to plug for our suppliers.”

The company said that a replacement store comes online to use its services every three minutes which the corporate receives an order from retailers every four seconds, on the average.

Now, with the new capital, TradeDepot will expand into a set of monetary services and lending products for its retailers. Many of the company’s customers lack a credit rating, but TradeDepot has other ways to attain credit supported the info it’s from its existing trading relationships.

“The founders’ vision to create a digital platform that improves the unit economics of serving the mass market is one we feel privileged to support,” said Wale Ayeni, the head of Africa risk capital investment at the IFC.

That support disproportionately goes to helping women entrepreneurs, consistent with the startup. Women account for over 75% of the retailers on the company’s platform. Now, with the assistance of its new investor We-Fi, TradeDepot will look to supply mentorship opportunities and link these business owners to global markets.

“Women play a pivotal role in driving economies across Africa, but lack of access to capital, limited market linkages, cultural norms and other challenges often prevent them from achieving the success they need,” said Hanh Nam Nguyen, who represents the We-Fi initiative with the IFC. “We-Fi financing will incentivise TradeDepot to create stronger women-led small and medium enterprises (SME) retailer and distributor networks, which can support them to become drivers of the economic process in their communities.”