OmniRetail has secured $20 million in Series A equity funding to fuel its expansion across Nigeria, Ghana, and Ivory Coast, as it works to modernise Africa’s traditional retail sector.

The company, founded by Deepankar Rustagi in 2019, is building what it calls a “network of networks” digitizing order management and providing embedded financial services to retailers, distributors, and manufacturers.

The funding round was jointly led by Norfund, the Norwegian development finance institution (making its first direct equity investment in an African startup), and Lagos-based venture capital firm Timon Capital. Other investors included Ventures Platform, Aruwa Capital, Goodwell Investments (via Alitheia Capital), and Flour Mills of Nigeria.

So far, OmniRetail has raised $38 million in equity and debt financing. Its platform connects 145 manufacturers, over 5,800 distributors, and more than 150,000 informal retailers across 12 cities, supported by a logistics network of over 1,100 vehicles and 85 warehouse partners.

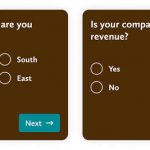

Retailers use the OmniRetail app to place orders, access working capital, and process digital payments.

Notably, the company turned EBITDA-positive in 2023 and achieved full profitability in 2024,a rare milestone for African startups.

“Our profitability is a result of efficiently utilising the assets we aggregated across the network. Our ‘network of networks’ model has proven both scalable and profitable,” said Rustagi. “This new capital will allow us to expand into more geographies and categories—not just to grow, but to optimise.”

Rustagi and OmniRetail’s head of investment, Archit Bagaria, attributes much of their success to their team’s deep experience in FMCG retail.

“For years, goods moved from point A to B, but a lack of transparency hindered financial inclusion and caused major inefficiencies,” Bagaria explained.

A major breakthrough for OmniRetail came with its move into embedded finance. Instead of rushing into credit services like many peers, OmniRetail waited until it reached a critical mass of users. That patience paid off.

In 2023, the company processed transactions worth over ₦1.3 trillion ($810 million) and now disburses around ₦19 billion ($12 million) monthly in inventory credit through its buy-now-pay-later (BNPL) platform, Omnipay, with near-zero default rates.

In 2024, OmniRetail strengthened its capabilities by acquiring Traction Apps, a Nigerian merchant solutions provider. The acquisition gave OmniRetail full-stack payment capabilities, including POS terminals, payment licenses, and access to rich sales data, allowing it to better assess retailer profiles and tailor credit offerings.

“In every FMCG transaction, goods and funds move together. We are now positioned to maximise value at every point along the value chain,” Rustagi said. “International players have succeeded using this model, and we are bringing it to Nigeria.”

Demonstrating a shift towards sustainable growth, OmniRetail no longer reports gross merchandise volume (GMV), a traditional startup vanity metric. Instead, it reports a 35% increase in net merchandise volume (NMV) and a 40% revenue growth over the past year, all while maintaining profitability.

The fresh funding will help OmniRetail expand into new product categories such as personal care, home care, and cold storage, while also strengthening infrastructure, improving credit underwriting, and deepening partnerships with local debt providers.

Bagaria noted that the company’s next steps include raising additional debt for inventory finance and pursuing strategic acquisitions.

“We are laser-focused on maintaining relentless profitable growth,” he said.

Speaking on the investment, Norfund’s Investor Director, Cathrine Conradi, said:

“Embedded finance is one of the most transformative tools for small business growth in Africa. OmniRetail’s model brings capital to places traditional systems have missed.”

Timon Capital added, “OmniRetail has hit an inflexion point across distribution, payments, and credit, demonstrating how much profitable growth is possible with their expanding footprint.”

OmniRetail’s goal is clear: to become the leading traditional retail platform in West Africa, not by replacing the old system, but by making it smarter, more transparent, and more profitable.