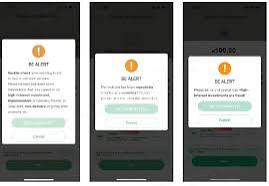

Just seconds before sending money, the offer seems too good to miss and the seller appears trustworthy — but a flashing alert from OPay changes everything:

“Caution — this account has been linked to suspicious activity.”

In that critical moment, instincts kick in, and many users realize they were on the verge of falling for a scam. This timely warning is part of OPay’s multi-layered scam alert system, an AI-powered defense network designed to detect and block fraudulent transactions in real-time.

At the core of this system is a machine learning engine trained on thousands of scam patterns, user reports, flagged accounts, and suspicious transaction behaviors. However, OPay’s approach goes far beyond a single pop-up alert.

One of the system’s key features is its abnormal transaction pop-up reminders. When suspicious activity is detected, users immediately receive a targeted warning. Every day, over 60,000 users encounter these alerts, helping prevent 30,000 risky transactions from going through.

For higher-risk transactions, OPay employs an intelligent outbound reminder system. Through SMS, email, app notifications, and customer service calls, the platform proactively reaches more than 10,000 users daily, discouraging over 8,000 fraudulent transactions.

Another innovative layer is the interactive Q&A verification system. In cases where additional context is needed, users are engaged with real-time prompts to confirm the purpose of their transaction. If red flags arise, the system either issues a stronger warning or halts the transaction entirely. This feature alone helps block over 46,000 scam attempts daily from more than 50,000 users.

Together, these tools create a dynamic, real-time scam prevention ecosystem that learns and improves with every user interaction. Many users are often unaware they are in danger until OPay intervenes. As one user shared on social media, “OPay alerted me that I might be sending money to a scammer when I wanted to patronize an IG vendor. Stopped the transaction ASAP.”

OPay’s scam alert system reflects a broader philosophy that financial security is built on both technology and trust. In addition to scam alerts, the platform offers Face ID transaction verification, USSD instant account locking, Large Transaction Shield, and automated callback alerts — all designed to protect users at critical moments.

As scams become more sophisticated, OPay is strengthening its systems to ensure users are protected before fraud occurs. The company’s real-time prevention strategies are helping reshape the future of financial safety in Nigeria.

Founded in 2018, OPay is a leading financial services company in Nigeria, dedicated to making financial services more accessible through technology. It offers a wide range of services including money transfers, bill payments, airtime and data purchases, card services, and merchant payments. Licensed by the Central Bank of Nigeria (CBN) and insured by the Nigeria Deposit Insurance Corporation (NDIC), OPay continues to provide Nigerians with fast, reliable, and secure financial solutions.