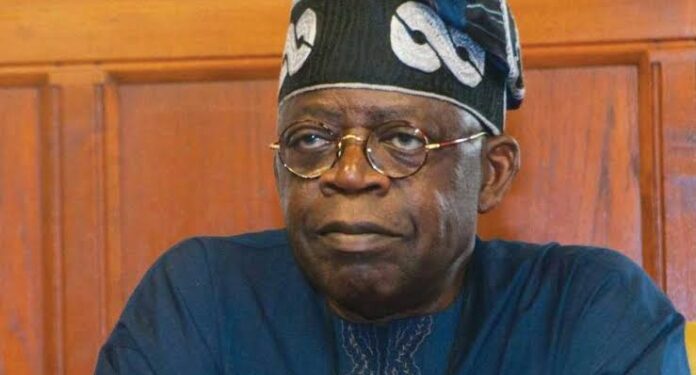

President Bola Tinubu has submitted a comprehensive Tax Reform Bill to the National Assembly, aimed at overhauling Nigeria’s tax system to drive revenue generation, simplify compliance, and support business growth. The bill proposes significant changes to corporate income tax, personal income tax, value-added tax (VAT), and the taxation of digital assets. Here’s a breakdown of the key provisions:

Corporate Income Tax (CIT):

- Small Companies (annual turnover below ₦50 million): Exempt from CIT.

- Other Companies:

- For the year 2025: 27.5% of taxable profits.

- From 2026 onwards: 25%.

Personal Income Tax (PIT):

- First ₦800,000: 0%.

- Next ₦2.2 million: 15%.

- Next ₦9 million: 18%.

- Next ₦13 million: 21%.

- Next ₦25 million: 23%.

- Above ₦50 million: 25%.

Withholding Tax (WHT):

As contained in the 2024 WHT Regulations.

Capital Gains Tax (CGT):

– 10% on gains from the disposal of chargeable assets, including real estate and shares.

Value Added Tax (VAT):

- For the year 2025: 10%.

- For the years 2026 to 2029: 12.5%.

- From 2030 onwards: 15%.

Digital Assets and Transactions:

– Taxed like financial instruments, with gains subject to 10% Capital Gains Tax

Key Highlights of the Bill:

- Digital Economy Inclusion: The bill introduces taxation on digital assets, online services, and fintech activities, aligning Nigeria’s tax system with global standards.

- Consolidation of Tax Laws: Simplifies tax administration by merging various tax regulations into one framework, reducing complexity for businesses and individuals.

- Tax Incentives: Small businesses with a turnover below ₦50 million are exempt from corporate income tax, encouraging entrepreneurship.

- Withholding Tax Adjustments: Streamlines WHT rates, ensuring deductions at source to curb tax evasion.

- Removal of VAT on Rent: Eliminates VAT on rent-related transactions, lessening the financial burden on property lessees.

- Taxation of Digital Gains: Clarifies that gains from digital transactions are subject to capital gains tax, reflecting the digital economy’s importance.

Strategic VAT Increase:

The VAT increase is set to roll out gradually, starting at 10% in 2025, rising to 12.5% between 2026 and 2029, and eventually reaching 15% by 2030. This phased approach aims to optimize revenue generation while minimizing the impact on businesses and consumers.

The New Nigeria Tax Bill, set to take effect in 2025, marks a significant step in modernizing the country’s tax system. By broadening the tax base, recognizing emerging sectors, and simplifying compliance, the bill is expected to drive economic growth and enhance fairness in Nigeria’s taxation system. The bill’s passing could signal a transformative era for Nigeria’s financial landscape, especially in terms of supporting small businesses and fostering a more inclusive economy.

Stay tuned for more updates as the National Assembly debates this landmark legislation.