Nigeria’s capital market is preparing for a new phase of reform as the Securities and Exchange Commission announced that the renewed Capital Market Master Plan will be directly aligned with the National Development Plan, a move expected to support the country’s ambition of building a one trillion dollar economy.

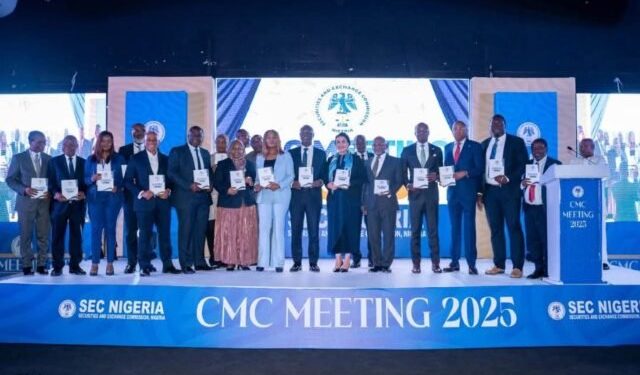

Speaking at the Capital Market Committee meeting in Lagos, the SEC director-general said the plan will guide development from 2026 to 2030, with room for extension to 2035 if needed. Rather than drafting an entirely new blueprint, the approach will involve continuous updates that reflect economic realities, allowing the market to evolve without disruption. He described the capital market as a tool that should sit at the centre of national planning, adding that Nigeria cannot achieve meaningful progress without integrating capital market policies into broader economic decisions.

He explained that the vision is for the capital market to serve as a springboard for national development, ensuring it features in discussions around growth, industrialisation, and investment. He insisted that market operators, regulators, development partners, and experts must contribute practical solutions. He further stated that progress is possible through daily actionable efforts, from easing challenges at ports to improving transport, healthcare, education, and other key infrastructure. Strong market systems, he said, are essential for business confidence, especially for MSMEs who rely on a stable environment to scale, access credit, attract investors, and expand.

Support for the review process is already in place from FSD Africa and the Nigerian Capital Development Fund, which have helped provide consultancy. Sensitisation sessions will follow to ensure that the revised strategy is practical within Nigeria’s economic context. The external steering committee will monitor implementation, working groups will focus on commodities, digital economy, liquidity, listings and sustainability, and performance will determine who remains involved. According to the SEC DG, those not included initially can volunteer, describing it as national service and emphasising that only stakeholders who deliver will stay in the implementation team.

He welcomed further recommendations from operators, including discussions around forming private equity groups to deepen capital access. He closed by describing the new document as a living framework that will be updated as the market progresses, intending to build a stronger, more competitive capital market that drives growth, boosts investor confidence and enhances Nigeria’s long-term economic prospects, especially for small businesses seeking expansion capital and smoother entry into the investment ecosystem.