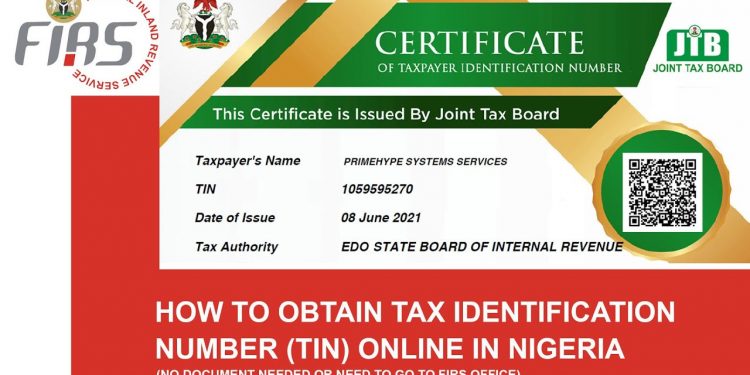

A Taxpayer Identification Number (TIN) is essential for any individual or company conducting business in Nigeria. Issued by the Federal Inland Revenue Service (FIRS), the TIN is a unique number that helps streamline tax payments and compliance. Whether you’re applying for a government loan, opening a business account, or getting an import/export license, having a TIN is a must.

Why You Need a TIN

- Obtaining a TIN is crucial for several reasons:

- It is required for opening business bank accounts.

- You need it when applying for government loans or trade licenses.

- It is essential when registering your business with government authorities.

- It’s needed for tax clearance, tax waivers, and other incentives.

The TIN Application Process for Individuals

For individuals looking to obtain their TIN in Nigeria, follow these steps:

1. Individuals can now apply for TIN online using their Bank Verification Number (BVN) To get a TIN as an individual, you need to have a NIN or BVN.

To register for TIN as an individual, click here.

2. Complete the form: Ensure you fill out all fields marked with an asterisk (*).

3. Attach necessary documents: Typically, these include a valid form of identification (driver’s license, international passport, or national ID card) and a recent utility bill.

4. Submit the form:

5. Get your TIN: After review, you will be notified once your TIN is issued.

For added convenience, individuals who already have a Bank Verification Number (BVN) or National Identification Number (NIN) can automatically get their TIN. You can verify if you’ve been assigned a TIN by visiting the Joint Tax Board’s (JTB) verification portal.

TIN Application Process for Companies

For non-individuals (such as limited liability companies, enterprises, or incorporated trustees), the TIN registration process is done online:

1. Visit the JTB TIN registration portal: Fill out the required fields with your business information.

2. Upload necessary documents: This typically includes the business registration certificate, memorandum & articles of association, particulars of directors, and a utility bill.

3. Submit the form: Once submitted, the FIRS will review the information and issue the TIN.

4. Receive your TIN: The process usually takes up to 10 business days, though it can extend to two months in some cases.

Documents Required for TIN Application

- For individuals: A valid ID (driver’s license, national ID, or passport), a utility bill, and a completed TIN application form.

- For registered but not incorporated businesses: Business name registration certificate, a utility bill, and a completed application form.

- For incorporated companies: Memorandum & Articles of Association (MEMART), certificate of incorporation, particulars of company directors, and share capital statement.

Important Notes for TIN Applicants

- The TIN application is completely free of charge. No payments are required.

- Ensure all details, including your address and phone number, are correctly filled out.

- Your TIN is unique to you or your business, and cannot be used by anyone else

- Individuals who obtain their TIN are not necessarily liable for taxes if exempted but still need to register for proper tax accounting and access to government incentives.

Verify your TIN

You can check online to see if you have an existing TIN by clicking here.

Getting a TIN in Nigeria is now easier and more efficient with the availability of online registration for both individuals and companies. The TIN is essential for MSMEs and larger businesses to ensure tax compliance, access government benefits, and conduct operations smoothly. By following the steps outlined here, you’ll be on your way to securing your TIN and setting your business up for success in Nigeria’s growing economy.