In a historic move, Sterling Bank has announced the migration to SeaBaaS, believed to be Africa’s first-ever indigenous core banking solution, underscoring its commitment to homegrown innovation and technological independence.

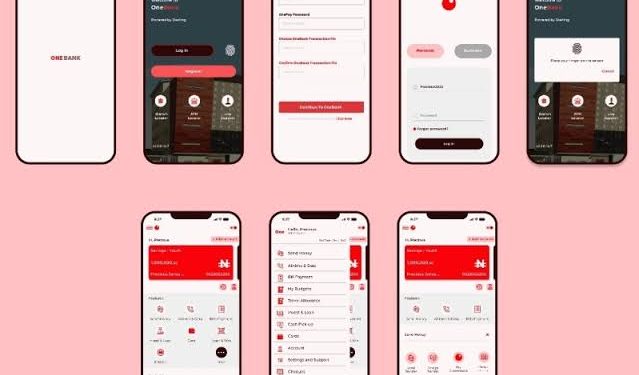

Coinciding with Workers’ Day 2025, the bank also unveiled a bold new feature on its digital banking platform, OneBank, called AlwaysOn by Sterling. This invitation-only feature will give eligible customers access to up to ₦1 million monthly, even when their account balances are low.

Described as a “movement,” AlwaysOn aims to remove financial barriers and empower Nigerians to act confidently in uncertain times. It offers instant access to funds to pay bills or manage emergencies without the friction of traditional credit systems.

“This is not just about funds,” said Abubakar Suleiman, CEO of Sterling Bank. “It’s about freedom and dignity. It’s about backing our customers with the trust and tools to act boldly when life demands it.”

He added that AlwaysOn is not a product but a shift in mindset a commitment to creating a more responsive and fair financial ecosystem for Nigerians.

AlwaysOn builds on Sterling’s Zero Transfer Fees initiative rolled out in April, which saved Nigerians an estimated ₦13 billion by eliminating transfer charges across the OneBank platform.

With this dual announcement the SeaBaaS core banking migration and the AlwaysOn feature—Sterling Bank continues to lead the way in digital innovation and customer-centric banking in Africa.