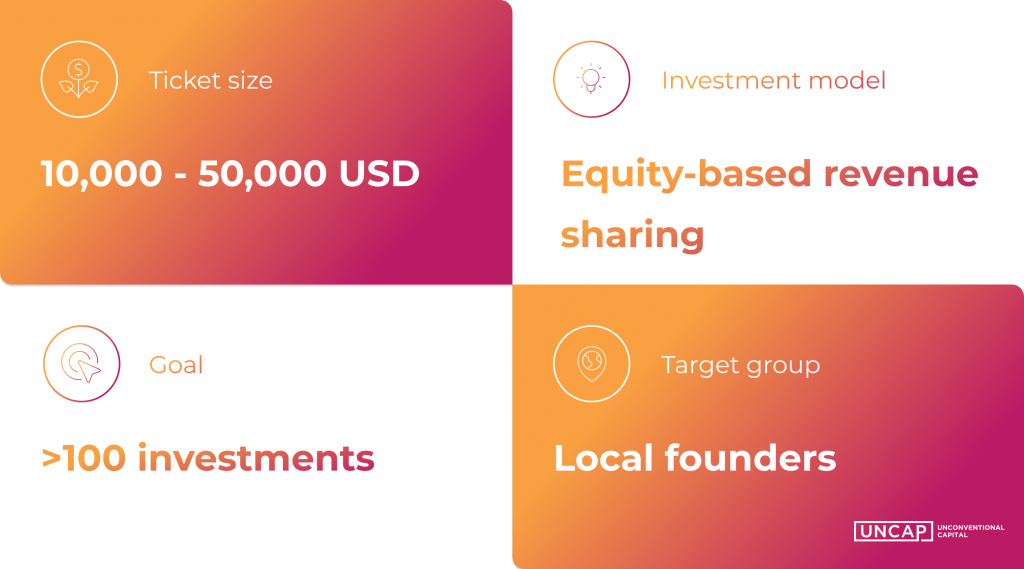

Uncap is a funding platform seeking to revolutionize access to early-stage funding in Africa. Their main mission is to make early-stage funding accessible to every good entrepreneur in sub-Saharan Africa. Early-stage entrepreneurs are usually considered too risky for bank financing and their funding needs are too large for microfinance and too small for venture capital investors. This led Uncap to develop a new way of funding using a fully remote, data-driven, and highly streamlined process as well as an innovative investment model. They will be furnishing existing businesses in need of capital between 10,000 and 50,000 USD.

Unconventional Capital has invested in 27 companies across several countries in sub-Saharan Africa as its pilot portfolio. Its founders are active in several sectors such as Agriculture, Education, Food & Beverages or Media & Entertainment.

Unconventional Capital has opened applications for the next investment cohort.

Why apply

- Smart, innovative early-stage funding

- Real-time financial analytics at your fingertips

- Curated resources and high class trainings to help you grow

Eligibility Criteria

- Local founder with an early-stage company and a scalable business model

- Must be located in Kenya, Uganda, Rwanda or Nigeria.

- Must be generating revenue traction

Benefits

- No collateral

- Unbiased decisions based on data to eliminate biases

- Between 10,000 – 50,000 USD equity to cover your early-stage funding need

Requirements

- Document of your registration as a company limited by shares

- Your most current tax certificate

- ID for verification process

- Business bank account details

- Do your bookkeeping with a web-based accounting software

According to the organizers, the application process is completely automated, unbiased, and focuses mostly on assessing the applicants’ entrepreneurial potential instead of pitchdecks, business plans etc.

Get more details and apply here