The Federal Inland Revenue Service (FIRS) has launched the e-invoice portal, a central platform that businesses in Nigeria must use to register and participate in the new electronic invoicing system. The portal is a key part of the government’s effort to modernise tax collection, improve compliance, and make business transactions more transparent.

Through the e-invoice portal, companies register their details, receive unique credentials including a Tax Identification Number (TIN), Business ID, and secret key and integrate their accounting systems with the FIRS Merchant-Buyer System (MBS). Once integration is complete, businesses can begin generating and transmitting electronic invoices that are validated in real time.

For MSMEs, the e-invoice portal is designed to simplify tax processes. Instead of relying on manual paperwork and delayed verification, the portal provides instant confirmation of invoices, ensuring they are authentic, accurate, and complete. This means small businesses will spend less time dealing with tax paperwork and more time focusing on growth.

The onboarding process is being implemented in phases. Large companies with annual turnovers above N5 billion are the first to be onboarded, with a deadline of November 1, 2025. After that, other categories of businesses, including MSMEs, will be directed to register on the portal. FIRS has already onboarded over 1,000 companies since the system went live on August 1, 2025, and more will follow in batches.

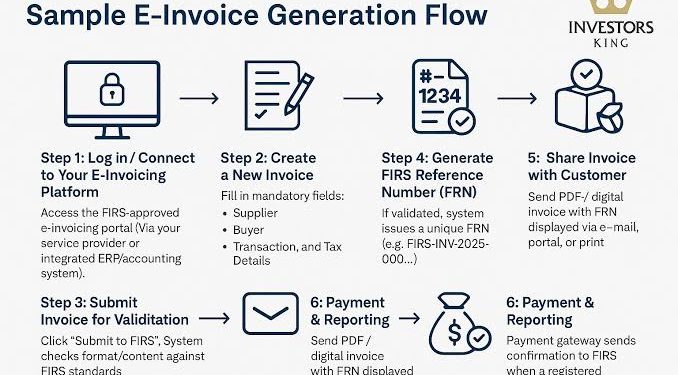

Steps to Onboard on the FIRS E-Invoice Portal

1. Registration on the Portal

Businesses must log onto the FIRS e-invoicing portal and complete their registration. During this stage, they also select an Access Point Provider (APP) licensed by FIRS.

2. Approval and Issuance of Credentials

Once the registration is reviewed, FIRS issues the company its Tax Identification Number (TIN), Business ID, and a secret key. These serve as the company’s access credentials.

3. System Integration and Configuration

Businesses integrate their accounting systems with the Merchant-Buyer System (MBS) through their chosen APP. This connection ensures that e-invoices can be generated and transmitted securely.

4. Start Generating Invoices

Once integrated, businesses can begin issuing e-invoices. Each invoice is validated by the APP, encrypted, and sent to both the trading partner and FIRS for approval.

Access Point Providers (APPs) play a central role in this process. They act as intermediaries, validating invoice data, ensuring accuracy of details such as TINs, transaction amounts, and VAT calculations, and transmitting the documents securely. Sixteen providers, including Remita Payment Limited, Etranzact International Plc, Hoptool Technology Limited, and Cryptware System Limited, have already been licensed by FIRS.

For small businesses, early familiarity with the e-invoice portal is essential. Beyond compliance, the system offers benefits such as better recordkeeping, faster processing, and improved credibility with partners. It also positions Nigerian MSMEs to meet global trade standards, as many international markets already require electronic invoicing.

The FIRS has assured that it will support businesses throughout the transition with workshops, webinars, and town hall meetings. By embracing the e-invoice portal, MSMEs can expect a simpler, safer, and more transparent way to manage transactions while staying ahead of tax regulations.