Nigeria’s entrepreneurial spirit is undeniable. Aspiring business owners dream of not just success, but of propelling the nation’s economy. Yet, the path from a groundbreaking idea to a thriving business can be bumpy. Access to capital, financial know-how, and navigating regulations are part of the challenges Nigerian entrepreneurs face.

Thankfully, Nigerian banks are stepping up to empower this vital sector. Partnering with government and private organizations, they’re launching a diverse range of initiatives tailored specifically to entrepreneurs’ needs. These initiatives aren’t only for funding, they also offer business advice, workshops, and even mentorship programs.

This well-researched blog post covers fifteen credible bank initiatives, programs and products available to Nigerian entrepreneurs. Do well to read through and apply to some of these opportunities. Good luck!

15+ Bank Initiatives, Programs and Products for Nigerian Entrepreneurs

1. Access Bank

Launched in July 2014, Access Bank’s “W Community” initiative empowers female entrepreneurs in Nigeria. The W Community offers financial inclusion, capacity-building programs, mentoring, and maternal health services. Participating women gain access to loans, financial management tips, special offers, and a supportive online community.

The initiative even provides access to fertility treatments, childbirth care, and various medical procedures. Ultimately, the “W Community” initiative aims to build a stronger generation of inspired, healthy, and empowered women. You can find all the details on their website.

Click here to visit the website.

2. First Bank of Nigeria

a. SME Connect

The SME Connect is an initiative of FirstBank Nigeria, licensed by the Central Bank of Nigeria. The initiative is committed to supporting small and medium-sized enterprises (SMEs) in Nigeria. The program offers a comprehensive package designed to fuel business growth.

Beyond just financial solutions, the SME Connect Initiative provides valuable resources including strategic advisory services, business seminars, and regular updates with helpful information. These resources cater to a wide range of SMEs, including small and medium-sized manufacturers, merchants, professional firms, agricultural businesses, religious organizations, and NGOs with annual turnovers between N5 million and N500 million.

Click here to visit the website.

b. The FirstGem Funds Initiative

FirstBank’s FirstGem Fund Scheme offers a single-digit loan specifically designed to support women in Micro, Small, and Medium Enterprises (MSMEs). This loan helps them meet their working capital and asset finance needs. They also partner with organizations like the Eloy Foundation for entrepreneurship development programs.

Click here to visit the website.

3. Ecobank

Ecobank partnered with the European Investment Bank (EIB) to provide financial support for small and medium-sized businesses (SMEs) and mid-sized companies (MidCaps) in Sub-Saharan Africa. This collaboration offers these businesses favorable loan terms and prioritizes sectors impacted by the COVID-19 pandemic.

Who can apply?

The funding is aimed at private sector companies with less than 3,000 employees. SMEs and women-owned or run enterprises in Nigeria are urged to apply.

Click here to visit the website.

4. Fidelity Bank

Fidelity Bank’s SME Banking offers a wide range of initiatives for SMEs and Entrepreneurs in Nigeria. These include:

- Loan products for MSMEs that have been tailored to help further ease the poor access-to-finance burdens.

- Low-cost current account offering for MSMEs.

- Fidelity SME Forum (a 30-minute knowledge-sharing program aimed at empowering Nigerian entrepreneurs).

Click here to visit the website.

5. Globus Bank

Globus Bank offers some initiatives for emerging businesses. Recognizing the financial challenges faced by Micro, Small, and Medium Enterprises (MSMEs), a crucial sector in the Nigerian economy, Globus Bank is stepping up to meet their needs.

The bank leverages digital infrastructure to expand its reach and offer MSMEs a comprehensive suite of financial and non-financial solutions. This “one-stop shop” approach, delivered through alternative channels, aims to empower MSMEs and foster their growth in the Nigerian economy.

These products include MSME Loans targeted at supporting businesses in these sectors to perform better in their daily operations.

Click here to see the criteria.

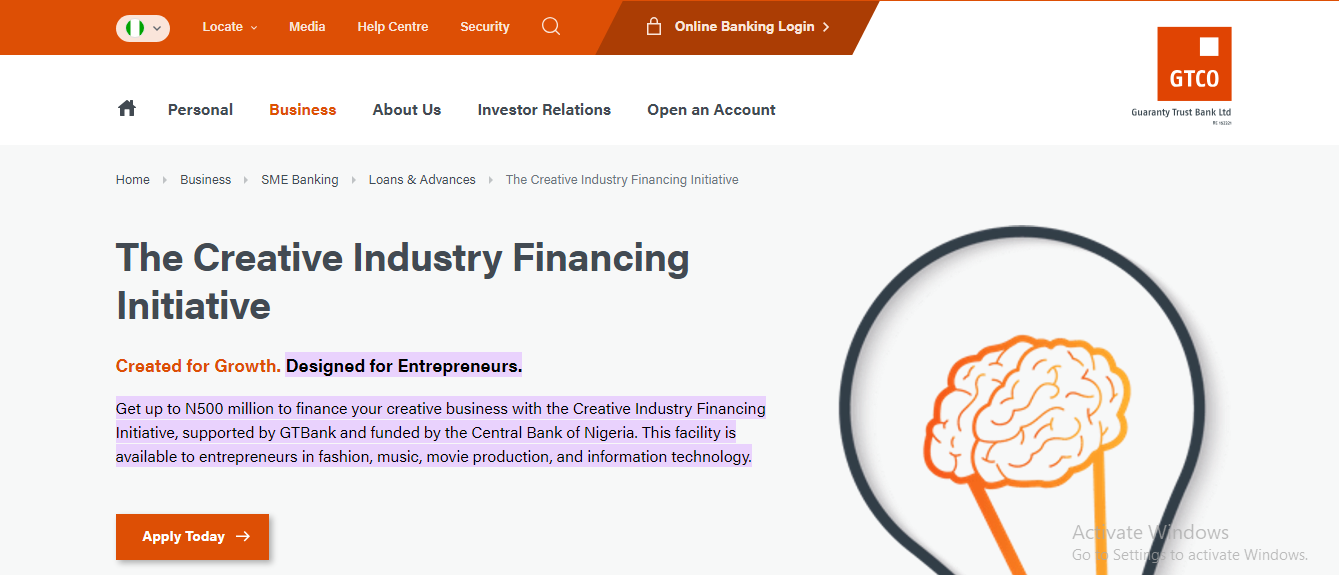

6. Guaranty Trust Bank

Guaranty Trust Bank in collaboration with the Central Bank of Nigeria (CBN) launched the Creative Industry Financing Initiative (CIFI), a loan scheme designed to support entrepreneurs in the creative sector. This initiative offers long-term financing with low interest rates for businesses in fashion design, music production and distribution, movie production and distribution, and information technology. It even includes a dedicated student software development loan program.

Click here to visit the website.

Join MSME Africa’s Community to receive the latest

financial opportunities for Entrepreneurs.

7. Keystone Bank

With Keystone Banks’ SME Banking program, Entrepreneurs and Small and Medium-sized Enterprises (SMEs) can find a valuable partner in their growth journey. This SME Banking program leverages strong partnerships, offering a comprehensive suite of value-added services designed to streamline operations and reduce costs. They go beyond basic banking by providing cost-saving solutions and a diverse array of financing options. To ensure a business’s success, they also extend financial advisory services, offering expert guidance to SMEs alongside the tools needed to thrive.

Click here to visit the website.

8. Optimus Bank

Optimus Bank is about to kickstart a tiered suite of business accounts designed to grow alongside your company. For the earliest ventures, the Optimus Business Starter (OB Starter) provides financial freedom with no account maintenance fees or monthly charges, perfect for nano businesses taking their first steps. As your business expands, the Optimus Business Mini (OB Mini) offers continued zero maintenance fees with a minimal monthly charge to support your growth, ideal for micro-businesses.

The Optimus Business Midi (OB Midi) caters to small businesses with its focus on financial flexibility and access to superior banking services at a competitive price. Finally, the Optimus Business Maxi (also coming soon) recognizes the needs of medium-sized businesses, offering a comprehensive solution to support their continued growth.

Click here to visit the website.

9. Polaris Bank

Businesses often dream of rapid growth, but this surge can bring unforeseen challenges. They might face a capital shortage to fund expansion, requiring new processes and systems to handle increased demand. Onboarding new employees, managing strained resources, and potentially outgrowing their current space are additional hurdles. Competition can also intensify during growth periods.

Polaris Bank recognizes these difficulties and offers solutions tailored to specific business needs. These solutions include SME loans, intervention funds with competitive rates for targeted industries, asset financing, invoice discounting, and working capital to fuel business activity. Polaris Bank also offers long-term expansion loans, payroll loans for employees, and merchant services for efficient payment processing.

Click here to visit the website.

10. Zenith Bank

Zenith Bank’s SME Grow My Business (SME-GMB) program caters specifically to micro, small, and medium-sized enterprises. This initiative offers a combination of financial and non-financial benefits designed to propel business growth across various industries. The program centers around a low-cost current account, allowing business owners to access essential services at minimal or no cost. These tailored offerings aim to enhance business efficiency, boost productivity, and ultimately, increase profitability.

Click here to visit the website.

11. Providus Bank

ProvidusBank, in collaboration with the Enterprise Development Centre, launched the ProvidusBank SME Program. This initiative empowers Nigerian business owners by equipping them with the skills and knowledge to develop long-term strategic plans.

Through the program, they learn to craft growth plans, refine their leadership skills, and define their business value proposition. Additionally, participants gain insights into building sustainable structures, crafting effective go-to-market strategies, and overcoming company-specific challenges through one-on-one advisory sessions. Moreover, the program fosters a collaborative environment where entrepreneurs can share ideas, learn industry best practices, and build a network for future growth.

The 4th Cohort closed recently. But you can join MSME Africa’s community to stay updated on the next opening.

Click here to visit the website.

12. Sterling Bank

The Sterling Mentorship Program connects SME business owners and entrepreneurs with experienced mentors in their chosen fields. This program offers guidance in various areas crucial for business growth, including finance, strategy & branding, sales & marketing, and digitization.

Beyond mentorship, the program fosters a supportive community among business owners. This community environment encourages collaboration, brand awareness building, and the exchange of valuable firsthand experiences, ultimately empowering entrepreneurs to navigate challenges and achieve success.

Click here to visit the website.

13. Suntrust

SunTrust Bank’s SME Flash simplifies financing for small and medium-sized enterprises (SMEs) lacking traditional collateral but seeking to grow their businesses. This umbrella product encompasses all the bank’s SME asset financing options. Recognizing the limitations some SMEs face, SunTrust Bank aims to make acquiring necessary equipment or working capital easier.

However, to qualify, businesses must have been operational for at least a year and maintained a banking relationship with SunTrust Bank for a minimum of three months. The SME Flash loan itself has a 12-month repayment term.

Click here to visit the website.

Join MSME Africa’s Community to receive the latest

financial opportunities for Entrepreneurs.

14. UBA

a. The Tony Elumelu Foundation (TEF) Entrepreneurship Programme

The TEF Entrepreneurship Programme is one of the most-sought after opportunities for Entrepreneurs throughout Nigeria and Africa. Not only has the initiative empowered hundreds of entrepreneurs, it has gained prominence by building a continent-wide network of trained entrepreneurs.

The Tony Elumelu Foundation Entrepreneurship Programme is not only open to Nigerians but Africans from all 54 African countries with scalable business ideas or a business that has been operational for no more than 3 years. Applicants must be 18 years of age and above.

Selected applicants will join a prestigious network of over 9,000 alumni and gain valuable resources to propel their ventures forward. This includes business training, mentorship, non-refundable seed capital of $5,000, and access to a global network of potential collaborators and investors.

The TEF Entrepreneurship Programme is a decade-long commitment with a $100 million investment. Its goal is to empower 10,000 young African entrepreneurs through training, mentorship, and funding. This initiative aims to create millions of jobs and generate revenue that fosters sustainable development across Africa.

Click here to visit the website.

b. The Women Entrepreneurship for Africa (WE4A) Programme

The “Women Entrepreneurship for Africa” (WE4A) programme empowers underserved communities in Sub-Saharan Africa, specifically women, young people, and the informal sector. This collaborative effort is funded by the European Union (EU), the Organisation of African, Caribbean and Pacific States (OACPS), and the German Federal Ministry for Economic Cooperation and Development (BMZ).

Implementation is overseen by the Tony Elumelu Foundation (TEF) alongside the German development agency GIZ (E4D program), with additional support from SAFEEM (Swiss Association for Entrepreneurship in Emerging Markets) for the Acceleration/Growth Programme.

This program strengthens the business capacity of women-led enterprises, enhancing their chances of securing follow-on funding from private investors. WE4A goes beyond initial support, offering an additional 3-month growth program with €50,000 in grant funding for up to 15 high-growth potential enterprises chosen by a panel of experts.

Join MSME Africa’s Community to receive an instant update on the next opening.

15. Wema Bank

Wema Bank is actively addressing the challenges faced by SMEs in Nigeria, recognizing that a lack of knowledge is a major hurdle. To bridge this gap, they offer various business advisory solutions. The SME Business School equips entrepreneurs with fundamental management skills to run their businesses effectively.

The Business Edge Masterclass workshops, delivered mostly virtually for wider participation, provide cutting-edge knowledge and skills in areas like strategy, digitalization, and funding.

Finally, the Quarterly SME Webinar serves as a virtual forum where experts and experienced entrepreneurs discuss topical business issues relevant to the Nigerian market. These initiatives demonstrate Wema Bank’s commitment to empowering SMEs with the knowledge and tools they need to succeed.

Click here to visit the website.

16. JAIZ Bank – Non-Interest Bank

Jaiz Bank (a non-interest bank) understands the crucial role Micro, Small, and Medium Enterprises (MSMEs) play in empowering individuals and driving economic expansion. MSMEs are considered the backbone of developing economies like Nigeria. This is why financing MSMEs is a major focus area for the bank, aligning perfectly with its mission of “Making Life Better Through Ethical Finance.”

Research suggests the growth of MSMEs is essential for national development, poverty reduction, and job creation.

Click here to visit the website.

17. Taj Bank

TAJBank focuses on empowering businesses through its Business Banking Group. They offer a comprehensive suite of non-interest financial products, including cost-plus financing, import finance, lease, and construction/manufacturing finance.

TAJBank is committed to fostering a supportive environment that propels Nigerian businesses towards sustainable profitability. Their unique non-interest model allows businesses to scale and achieve growth without the burden of traditional interest-based financing.

Furthermore, TAJBank boasts a team of experienced professionals who guide clients throughout the investment and transformation process, mitigating risks and ensuring consistent, predictable success.

Click here to visit the website.

Now that you know of some of the bank initiatives created to support entrepreneurs in Nigeria and Africa, it is up to you to utilize the opportunities.

MSME Africa remains committed to promoting credible opportunities for Nigerian and African entrepreneurs. Be in the know by joining our community.

Author: Victor Odeyemi.