Please ensure you read through the previous editions on this topic, for a better flow and understanding.

We started with differentiating between Withholding Tax (WHT) and Value Added Tax (VAT) and we touched on WHT rates last week. I am going to continue on WHT rates in this edition, giving few examples that will show what WHT rate to apply when paying a vendor/service provider.

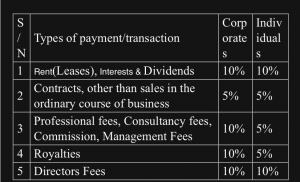

The above table shows the WHT rate applicable to each class of transaction.

If Mr. A owns a property which is leased out to a business owner, in paying the rent amount to Mr. A, the business owner has to withhold tax at 10% of the rental amount due, and pay the tax to the internal revenue service (IRS) of the state where Mr. A is resident. If the owner of the property is JMK LTD, the deducted tax will be payable to the Federal Inland Revenue Service(FIRS).

Let us say Mr. A saved some money with Hush Bank PLC and after a month, the Bank pays Mr. A interest on his savings, the Bank is required to deduct 10% of the interest amount, remit the tax to the state internal revenue service where Mr. A lives, and pay Mr. A the reduced interest amount. When the customer is a corporate entity, the deducted tax will be 10% also, but paid to the FIRS.

For Contracts of sales and service, the WHT rate applicable is 5% of the contract amount, irrespective of the nature of the vendor/service provider. These are regular contracts such as sales, supplies, maintenance etc.

For Professional fees, the rate is 5% of the fees when dealing with an individual – Remember, an individual under the Nigerian tax regime includes sole proprietors, partnerships, agencies and other non-corporates. The fees payable to these classes of service providers is to be subjected to 5% WHT when paying for their services. For professional fees payable to Corporate entities, the WHT rate to use is 10%.

Perhaps the trickiest part of the WHT regime is the definition of “professional fees”. This qualification is not explicitly defined in the laws governing the tax, making it open to interpretation of whoever is trying to define it. The FIRS has also tried to give explanatory notes on it but in practice, it is still a major bone of contention during audits. Loosely, when the provider of a service requires a certification (from a professional body) before it can carry on its business or the duties of the services require “specialized skills”, it is said to be professional in nature. As mentioned earlier, these are opinions and although they are common and accepted in practice, the existing tax laws do not have them defined.

Out-of-pocket payments, over-the-counter purchases, reimbursable expenses are few examples of payments not liable to WHT deduction. Extreme care has to be taken to examine the substance of these instances and ensure relevant support documents are kept to defend the nature of the transactions.

Please note that although Withholding Tax is not the burden of the deducting party to bear (the paying party is only appointed as an agent of deduction(, failure to deduct or apply the appropriate rate will attract penalties and interests which could result in loss of revenue and reputational damage).

Akinjide Akande B. Eng. ACA, ACTI is a seasoned tax professional with over 12 years of experience in Tax Compliance, Advisory, Accounting and Automation. He started his career with one of the top 4 accounting firms before proceeding to a leading Tax professional services firm where he gathered knowledge and hands-on experience in Nigerian taxes in the areas of accounting, advisory, compliance, automation, dispute resolution and adjudication. He has served as a tax consultant in various industries including the financial services, manufacturing, IT and FMCG sectors. He has a good grasp of the relevant tax statutes and the practice of tax in Nigeria. He currently works as the tax manager for a leading bank in Nigeria.He can be contacted via email : akinjidayakanday@gmail.com