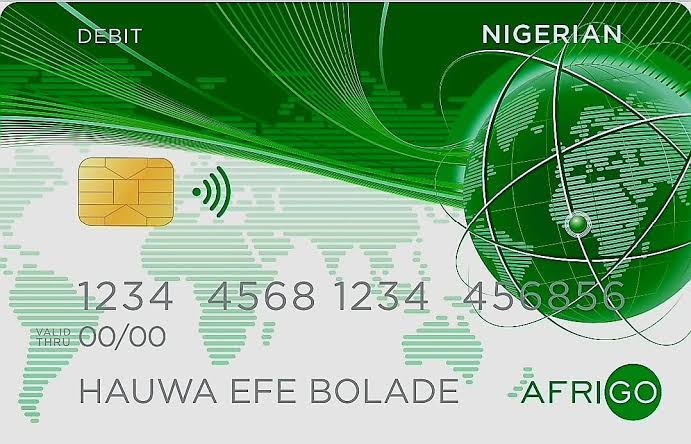

The Central Bank of Nigeria on Thursday launched AfriGo, a Nigerian National Domestic Card Scheme meant to boost the electronic payment system in the country.

The Central Bank Governor, Godwin Emefiele, during the launch which was done virtually, said the card would help to reduce operating cost, charges and preserve foreign exchange in the country.

Emefiele said, “Ladies and gentlemen, at this time when foreign exchange challenges persist globally, it is important that I say that we have come up with this card to ensure that all online transactions will now effective immediately begin to go on the Nigerian National Domestic Card system.

“All domestic transactions that are going to be conducted in Nigeria will have to be through the Nigerian domestic cards.”

He said, many Nigerians were still excluded from the penetration of card payments in Nigeria which has grown tremendously over the years.

He added, the high cost of card services as a result of the foreign exchange requirements of international card schemes, and the fact that current card goods do not address regional specifics of the Nigerian market are some of the difficulties that had hampered the inclusion of Nigerians.

He said that the Bank aggressively advocated the National domestic card system, which would be available to all Nigerians and also take into account local features, in light of the limited usage of cards by Nigerians and in an effort to improve penetration.

He added, “But given that charges by foreign cards are in dollars, we will no longer pay dollars for the charges on those cards. Particularly, we would only pay dollars for charges for transactions that are done with whether they are domestic cards or foreign cards outside Nigeria”

The banking regulator said the CBN, Nigeria Inter-Bank Settlement System Plc and the Nigerian banks would work together on how to segregate those transactions to ensure that they would only make charges or fees for international transactions that are conducted on the cards or the Visa or MasterCard.

“I thought it important for me to say so not because there’s any preference for the domestic card but what is most important is that we do not have foreign exchange and we will bar payment of charges for domestic transactions from the Nigerian foreign exchange market at some point in the very near future,” he said.

AfriGOpay Financial Services Limited (AFSL), a NIBSS-affiliated organisation, is responsible for deploying and overseeing the adoption of the national domestic card scheme.