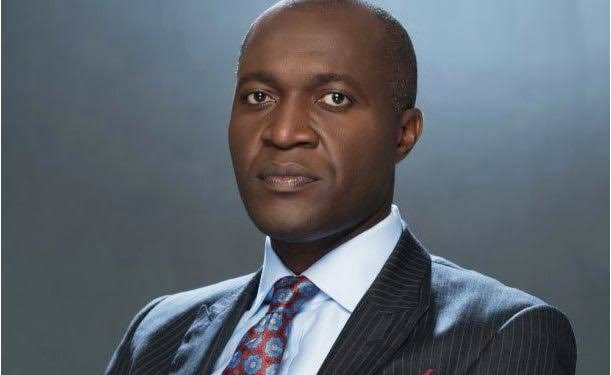

Africa’s Micro, Small, and Medium-sized Enterprises (MSMEs) continue to power the continent’s economy, yet they face a staggering trade finance gap of around $120 billion. This was the concern raised by the Managing Director and CEO of Access Bank, who spoke during the Africa CEO Forum held in Abidjan.

He stressed the urgent need for financial institutions to develop innovative strategies that provide MSMEs with the liquidity they need to grow and scale. According to him, these small businesses are central to Africa’s economic transformation but remain heavily constrained by limited access to trade finance. He noted that without urgent reforms in financing, Africa risks stalling the growth of its most vital economic contributors.

“Financial institutions must innovate to close this finance gap and provide the liquidity these businesses need,” he said. “These MSMEs are not looking for handouts. They are looking for access, tools, and platforms that allow them to do what they already know how to do: create value.”

Reinforcing his call for support of local industries, he challenged Africans to change their perception of locally made goods. He pointed out that global brands such as “Made in China” and “Made in Taiwan” were once viewed with skepticism but now represent quality and innovation due to the deliberate industrial strategies of those countries. Africa, he said, has the same opportunity, if it builds strong domestic markets and policies that support enterprise.

“There is no reason Africa has not yet transformed itself into the powerhouse we know it can be. We have the natural resources, the population, and the ambition. What we need is action, and that begins with buying Africa and believing in Africa.”

He reiterated his long-standing message: that the private sector must lead in transforming intra-African trade and boosting the visibility of African-made products on the global stage.

The conversation also shifted toward policy and infrastructure, with other speakers highlighting systemic barriers to integration and development. The Secretary-General of the African Continental Free Trade Area (AfCFTA) spotlighted measures already in motion to boost trade under the agreement, such as the introduction of the e-tariff book designed to simplify access to tariff data and the AfCFTA Adjustment Fund, which will help nations implement structural reforms and mitigate short-term trade shocks.

Meanwhile, the President and CEO of Africa Finance Corporation (AFC) emphasized that the lack of infrastructure continues to slow Africa’s progress, especially in logistics, power, and connectivity. He stressed that achieving development priorities requires strong collaboration between the public and private sectors. With aligned interests and strategic partnerships, he believes Africa can rapidly finance and deliver its infrastructure needs to support enterprise and inclusive growth.

Discussions at the Africa CEO Forum made it clear that MSMEs must be central to Africa’s development plans. Bridging the trade finance gap, improving infrastructure, and fostering a culture that supports and believes in local production are all essential if the continent is to realize its full economic potential. At the heart of this vision is the belief that Africa has all it needs to succeed—what remains is the political will, financial innovation, and collective commitment to unlock it.