The Central Bank of Nigeria (CBN) has set aside another increased the amount set aside for the Target Credit Facility (TCF) for households, Small and Medium Enterprises through the Nigerian Incentive-based Risk Sharing System for Agriculture Lending [NIRSAL] Bank to N300b.

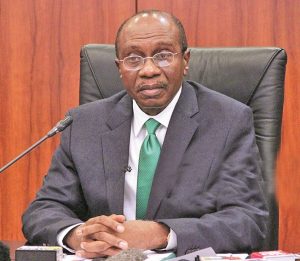

CBN Governor, Godwin Emefiele disclosed this, yesterday, while declaring open the 30th Seminar for Finance Correspondents and Business Editors (FICAN) held in Abuja.

The theme of the seminar is ‘Leveraging Digital Economy to Drive growth, Job Creation and Sustainable Development in the Midst of a Global Pandemic’.

Emefiele, represented by CBN Deputy Governor, Corporate Services, Edward Lamtek Adamu, stated that in line with the growing need to go digital, the application processes are done online, which requires limited paperwork from prospective applicants.

Emefiele in his statement said, “We initially created a N150bn Targeted Credit Facility for affected households and small and medium enterprises through the NIRSAL Microfinance Bank. Already, N149.21bn has been disbursed to 316,869 beneficiaries.

“Given the resounding success of this programme and its positive impact on output growth, we have decided to double this fund to about N300bn, in order to accommodate many more beneficiaries and boost consumer expenditure which should positively stimulate the economy.”

On the issue of remittances, the CBN Chief said the bank has continued to improve its remittance infrastructure to provide Nigerians in the diaspora with cheaper, convenient and faster channels for remitting funds to beneficiaries in Nigeria.

He said to reduce the cost of remitting funds into Nigeria, the CBN on March 8, 2021 introduced a refund of N5 for every $1 remitted into the country through IMTOs licensed by the CBN.

“We believe this measure would help to support improved foreign exchange inflows and enable Nigerians in the diaspora to use more formal channels relative to informal channels,” he said.